Stay in the know

We’ll send you the latest insights and briefings tailored to your needs

Following the release of the International Sustainability Standards Board’s (ISSB) sustainability standards (ISSB Standards) on 26 June 2023 – a significant milestone in global climate reporting - and the publication of the Australian Treasury’s second consultation paper on the proposed mandatory climate-related financial disclosure regime in Australia (Consultation Paper), businesses and interest groups around Australia have had their say on what the proposed new reporting landscape might mean to them.

As noted in our earlier update, the ISSB Standards are intended as a common language and global baseline for sustainability and climate-related disclosures. They were developed promote detailed and useful disclosure for investors and the public in relation to companies’ environmental, social and governance (ESG) profiles. As recently observed by Joe Longo, Chair of the Australian Securities and Investments Commission (ASIC), ESG issues are ‘driving the biggest changes to financial reporting and disclosure standards in a generation’.

The next step is for individual jurisdictions to implement the ISSB Standards, with globally consistent disclosures anticipated from 2024. Following initial consultation in in December 2022 until February 2023, the Australian Treasury release of Consultation Paper sees Australia enter the next phase of consultation on the design of the legislative framework to support the implementation of the ISSB Standards.

Importantly, at this stage, the Consultation Paper is focused on climate-related financial disclosures, being based on the ISSB’s Sustainability Disclosure Standard IFRS S2 Climate-related Disclosures (IFRS S2) only. It is not yet proposed that Australia adopts the broader general sustainability-related framework outlined in Sustainability Disclosure Standard IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information.

Summarised below are some of the key features of the ISSB Standards and the Australian Government’s current position in relation to a number of key issues.

Topic |

Takeaway |

||||||||||

|

Commencement |

While the ISSB Standards would apply with effect from 1 January 2024, the Treasurer has indicated that the Australian regime would commence on 1 July 2024:

|

||||||||||

|

Coverage |

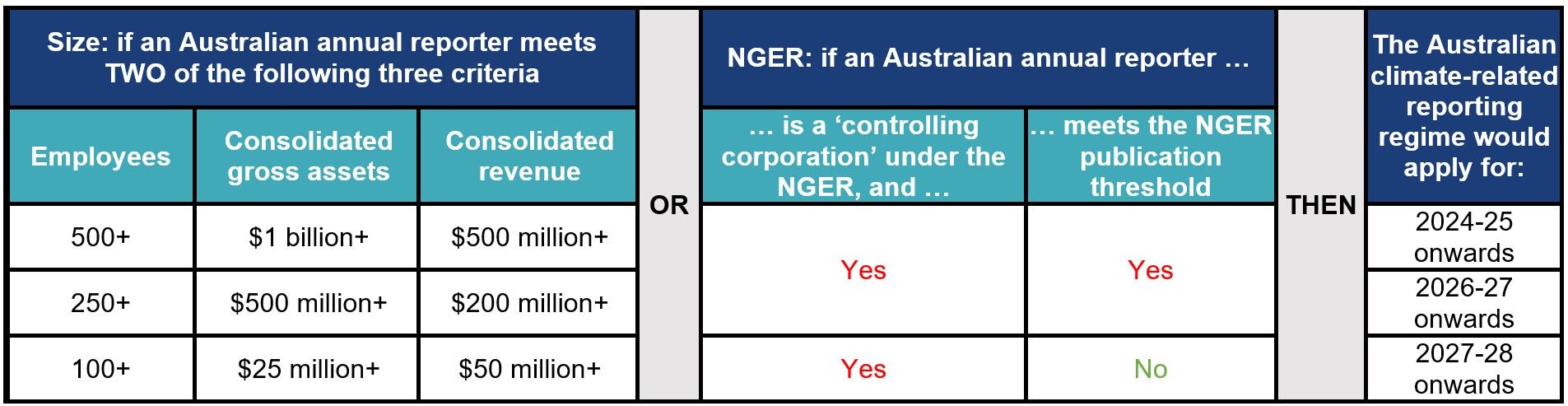

The Australian regime would phase in mandatory climate-related disclosures for any entity required to report under Chapter 2M of the Corporations Act 2001 (Cth) (Corporations Act) – i.e. Australian disclosing entities, public companies, large proprietary companies and registered schemes (Australian annual reporters) – that either:

Practical issues for corporate groups Within a large corporate group, it is relatively common for there to be multiple entities which meet the criteria to report under Chapter 2M. While many of them will be relieved of their reporting obligations on the basis that they are wholly-owned and meet the conditions for ASIC general class order relief (and have entered into deeds of cross guarantee), it is quite common for certain types of entity to be required to separately report as they do not qualify for class order relief. Common examples include:

Separately reporting for these types of entities is likely to be onerous, given the extent to which climate governance structures, strategies, risk management processes and targets and metrics are set on a group basis (rather than entity basis) and individual analysis is not undertaken on a ‘per entity’ basis. Despite this, based on the way in which the Consultation Paper is currently drafted, each such Australian annual reporter that meets the tests set out above would be required to comply with the new Australian climate-related reporting regime. We have raised with Treasury that this may pose significant practical challenges. Practical issues for internationally-headquartered groups In the context of an international group, similar issues will arise given that the Australian regime would apply at the Australian annual reporter level. Specifically, as the proposed regime is currently envisaged, an ISSB Standard-aligned annual report for the global group would not be sufficient to meet Australian requirements (unless the group has no Australian annual reporters). |

||||||||||

|

Officers’ and companies’ liability |

The ISSB Standards, which would require reporting entities to report on certain forward-looking information and inherently uncertain matters, do not deal with the implications of such disclosures for reporting entities and their officers. This has been a much-debated issue in Australia. On the one hand, there is a view that such disclosures expose reporting entities and their officers to additional liability risk, and accordingly, a degree of protection should be provided. On the other hand, there is a competing view that such protection would not be necessary if directors act diligently by ensuring that such statements are made on reasonable grounds. As a compromise, Treasury is proposing a time-limited protection against liability, whereby elements of mandatory disclosure will be afforded protection from private litigants in relation to claims for matters such as misleading or deceptive conduct, and false or misleading representations. This would extend to disclosures such as scope 3 reporting, scenario analysis, and transition planning. However, this protection would only be available for the first three years from the regime’s commencement. In addition, it would not be available for actions taken by regulators such as ASIC. Given these protections would fall away, prior to the reporting requirements becoming mandatory for the smallest cohort of reporting entities, our submission to Treasury has proposed that this limited liability regime should apply to the first three reports following the introduction of the mandatory requirements. Treasury has considered making broader protections available, such as a ‘good faith disclosure’ defence and a ‘safe harbour’ defence (whereby liability would not attach to forward-looking statements identified as such accompanied by a proximate cautionary statement, or statements supported by suitably qualified external advice and made following reasonable steps). However, these broader protections were not ‘preferred’. |

||||||||||

|

Statement of compliance |

Under the ISSB Standards, a reporting entity whose sustainability-related financial disclosures comply with all the requirements of the ISSB Standards would be required to make an ‘explicit and unreserved statement of compliance’ (subject to any domestic laws prohibiting the disclosure of information or permitting the omission of information, such as any ‘unreasonable prejudice’ exceptions). The Consultation Paper is not specifically seeking feedback on this issue and is likely to be considered and addressed during local implementation. |

||||||||||

|

Materiality |

The ISSB Standards have settled on a ‘single materiality’ requirement, whereby entities would be required to disclose material information about sustainability- and climate-related risks and opportunities that could reasonably be expected to affect the entity’s prospects. Consistent with the International Financial Reporting Standards, the assessment of materiality would be approached by considering if omitting, misstating or obscuring the information could reasonably be expected to influence decision-making of the primary users of financial reports. In Australia, there has been debate as to whether a ‘double materiality’ requirement, whereby entities would be reporting on both what is material to them and what is material to the external environment, should be adopted. However, Treasury has indicated a preference for a ‘single materiality’ requirement in its Consultation Paper. The Consultation Paper has stated that ASX guidance will also be released in due course in relation to how the new regime interacts with Australian continuous disclosure obligations, recognising the different concept of materiality which applies in that context. |

||||||||||

|

Scenario analysis |

IFRS S2 calls on reporting entities to disclose how and when climate-related scenario analysis was carried out, including (among other things) whether the entity used, among its scenarios, a climate-related scenario aligned with the Paris Agreement. The Consultation Paper goes further and proposes a number of prescriptive requirements, including that:

|

||||||||||

|

Scope 3 emissions |

IFRS S2 would require entities to report on their Scope 1, Scope 2 and Scope 3 emissions in accordance with the Greenhouse Gas Protocol (GHG Protocol). A concession is made where, in a reporting entity’s first annual report under the ISSB Standards, a non-GHG Protocol methodology may continue to be used. Under both IFRS S2 and the Consultation Paper, scope 3 emissions are not mandatory for first-year reporting. The Consultation Paper proposes a further relief whereby scope 3 emissions reported for a financial year may be incurred in any one-year period that ended up to 12 months prior to the relevant reporting period. This is to recognise that other reporting entities’ scope 1 and 2 emissions may form inputs for an entity’s scope 3 estimation. |

||||||||||

|

Transition plans (incl. climate targets and use of carbon credits) |

Both IFRS S2 and the Australian regime would require disclosures on transition plans. IFRS S2 prescribes a number of additional details, including the key assumptions and dependencies underlying such plans. As part of the disclosures on transition plans, both IFRS S2 and the Consultation Paper would require reporting entities to make disclosures in relation to:

In Australia, some stakeholders have suggested that transition plans aligned with the Paris Agreement should be mandated. However, the Consultation Paper rejected this view and affirmed that the aim of the requirement is only to improve transparency. |

||||||||||

|

Industry-based metrics |

IFRS S2 calls on reporting entities to report on industry-based metrics (along with cross-industry metric categories, and targets set by the entity). The Consultation Paper proposes that disclosures against industry-based metrics be made mandatory in Australia by 2027-28, where there are well-established and understood metrics for a reporting entity. |

||||||||||

|

Internal carbon prices |

IFRS S2 would require a reporting entity to disclose whether and how it is applying a carbon price in decision-making, and the price for each metric tonne of greenhouse gas emissions. In Australia, some stakeholders have suggested that internal carbon prices should be aligned to Australia’s future carbon pricing mechanism. However, the Consultation Paper again rejected this view and indicated that the requirement is only aimed at standardising disclosures (and not internal carbon prices). |

||||||||||

|

Assurance |

The Consultation Paper proposes a staggered approach to climate disclosure assurance. Under this proposal, Australian annual reporters would be required to undertake a four-step assurance process, commencing in the year in which the Australian regime first applies to them:

|

||||||||||

|

Enforcement |

Under the Australian regime, climate-related financial disclosure requirements would be drafted as civil penalty provisions in the Corporations Act. This means that protections for a person who has acted honestly and ought to be fairly excused would be available under ss 1317S and 1318 of the Corporations Act. |

The consultation closed on 21 July 2023, following which exposure draft legislation is set to be released in due course.

Separately, the Australian Accounting Standards Board is expected to consult on Australian standards based on the ISSB Standards in the second half of 2023, with the final Australian standards currently anticipated for release in Q2 2024.

If you have any questions in relation to the implementation of the ISSB Standards in Australia and its implications for companies and their officers, please contact a member of the Head Office Advisory Team.

The contents of this publication are for reference purposes only and may not be current as at the date of accessing this publication. They do not constitute legal advice and should not be relied upon as such. Specific legal advice about your specific circumstances should always be sought separately before taking any action based on this publication.

© Herbert Smith Freehills 2024

We’ll send you the latest insights and briefings tailored to your needs