In brief

- Herbert Smith Freehills has published a new book, Towns Under Siege, looking at contemporary developments in Australian takeovers and schemes.

- The book contains the results of a survey of non-executive directors of ASX companies gauging their view on various topical issues in takeovers.

- Results from the survey indicated that a significant proportion of directors considered that listed companies could do more to prepare for an approach from a bidder and that directors consider a bid from private equity differently to a trade buyer.

The view from the top: director survey

Herbert Smith Freehills has conducted an anonymous survey of non-executive directors of ASX company boards to gauge their perspectives on a number of topical public M&A issues.1

Broadly, the survey covers the following areas: preparation for a takeover bid, takeovers and the board, assessing takeover bids and takeover law reform.

Some key findings from the survey, including the various questions and answers, are summarised below.

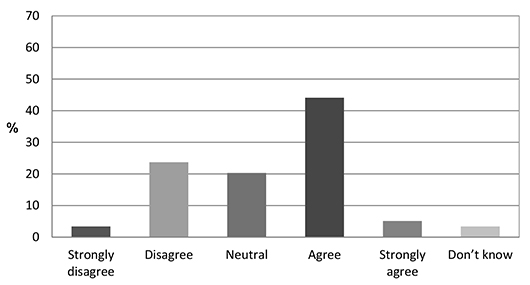

Takeover preparation: Do you consider that most companies are adequately prepared for an approach from a bidder proposing a change of control transaction?

The importance of adequate preparation prior to the receipt of an unsolicited approach from a bidder is considered in detail as a key element of a target board’s role in Towns Under Siege. On this topic, it is interesting to note that a significant proportion of respondents did not consider that most companies were adequately prepared for an approach by a potential bidder.

Responses received to the open-ended question reinforced this view, with one respondent noting “I suspect that many Board members do not really know what being ready entails until they are in the thick of things”. Likewise, another respondent raised the difficulty of convincing fellow directors to undertake preparation for a possible bid in advance, particularly in preparing and updating a company valuation model.

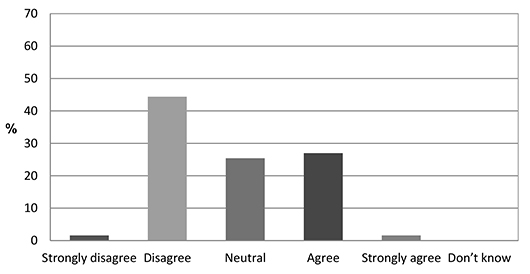

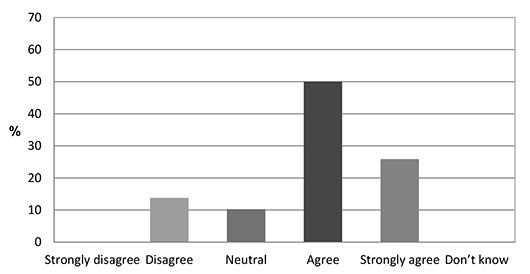

Takeovers and the board: Are target boards given sufficient discretion in determining whether and when to publicly disclose approaches from potential bidders?

Approximately half of the respondents agreed or strongly agreed that target boards are given sufficient discretion when determining whether to publicly disclose approaches from potential bidders.

Conversely, around a quarter of respondents considered that target boards did not have sufficient discretion to determine whether to disclose an approach from a potential bidder. One respondent considered that “disclosure is required too early, sometimes jeopardising a solid offer and negotiation”.

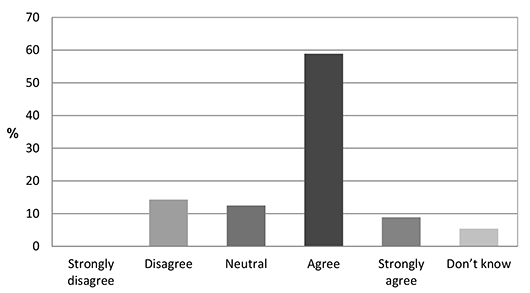

Assessing takeover bids: Do target boards approach considering a potential bid from private equity differently from another bid (for example, from a trade bidder)?

Nearly 70% of all respondents agreed or strongly agreed with the statement that target boards treat approaches from private equity differently from other bidders.

This should not be necessarily considered as a bad result for private equity. What it does do, however, is reinforce the view that an approach by private equity will be treated cautiously by the board of the target, as compared to an approach from a trade buyer for instance. Clearly, private equity approaches can and do result in change of control transactions, but it is nonetheless important that private equity buyers are mindful of these issues when they are formulating their approach strategies.

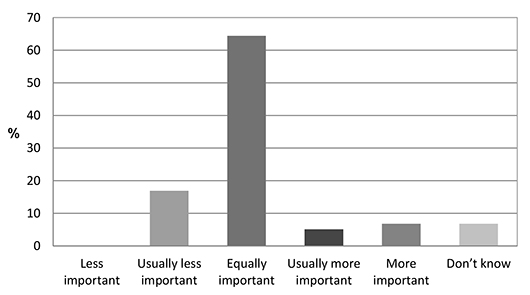

Assessing takeover bids: When considering an offer for a potential change of control transaction how important are the conditions of the offer compared to the amount of the offer?

A significant majority of respondents considered that the conditions of the potential change of control offer were equally important as the quantum of the offer.

Around 17% of respondents considered that the conditions attaching to the offer were less important than the quantum of the offer, with slightly more than 10% of correspondents considering that the conditions of the offer were usually more important or more important.

The importance placed on the conditions of the offer presumably reflects concerns as to how “real” and “tangible” the offer from the bidder is.

Assessing takeover bids: Do you consider that short term interests of investors play too significant a role in determining the outcome of change of control transactions?

Another clear result from the survey was the widespread view of respondents that short term interests of investors play a disproportionate role in determining the outcome of bidding contests. A quarter of respondents strongly agreed that investor short term interests play too significant a role in determining the outcome of contests for control, with a further 50% also agreeing with this view. This finding also follows on from public commentary from a number of high profile directors on short-termism.

New book on takeovers and schemes

Herbert Smith Freehills has published a new book on public M&A in conjunction with the Ross Parsons Centre of Commercial, Corporate and Taxation Law at the University of Sydney.

Towns Under Siege, edited by Herbert Smith Freehills partner Tony Damian and senior associate Clayton James, contains contributions from the Executive of the Takeovers Panel, the Australian Securities and Investment Commission, and a number of leading practitioners from Herbert Smith Freehills.

To purchase a copy of the Towns Under Siege, please click here.

This article was written by Tony Damian, Partner, and Clayton James, Senior Associate, Sydney.

Endnotes

The survey received a total of 64 responses. The survey was structured as 12 multiple choice questions and a single open-ended question which asked respondents if they had any other comments on takeovers practice or the role of boards in takeovers and schemes of arrangement.

More information

For information regarding possible implications for your business, contact Tony Damian.

Legal Notice

The contents of this publication are for reference purposes only and may not be current as at the date of accessing this publication. They do not constitute legal advice and should not be relied upon as such. Specific legal advice about your specific circumstances should always be sought separately before taking any action based on this publication.

© Herbert Smith Freehills 2024