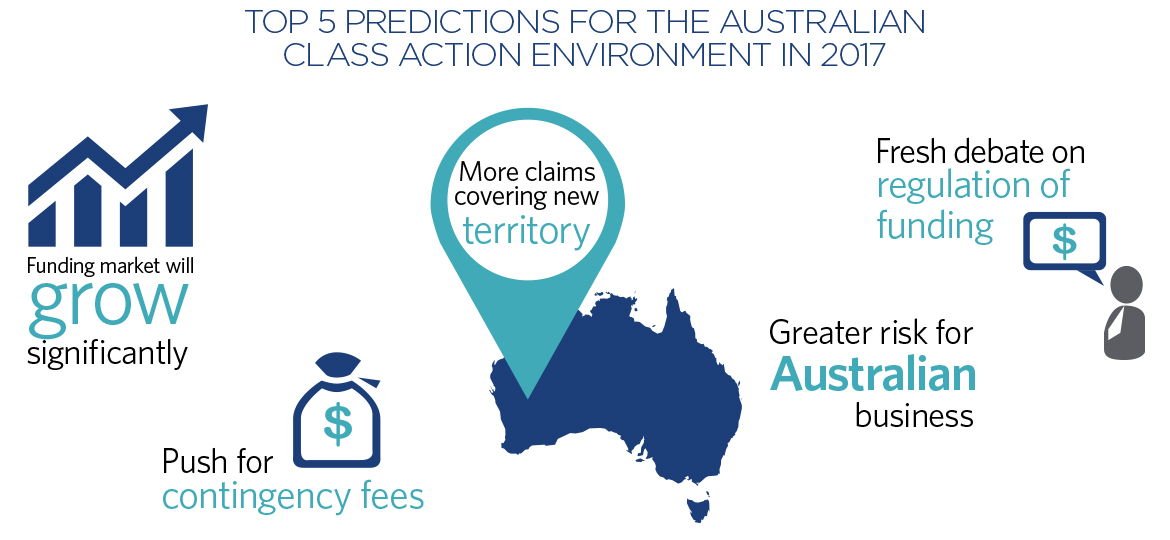

Here are our top 5 predictions for what’s in store for the Australian class action environment in 2017.

It has been a landmark year for Australian class action litigation with some significant decisions and settlements, a rash of new cases commenced, and the approval by the Full Federal Court of a ‘common fund’ doctrine which makes pursuing class actions more economical than ever for third party funders.

We take a moment to ask: What’s in store for the Australian class action environment in 2017?

Here are our top 5 predictions

1. Funding market will grow significantly

While the Australian funding market has experienced steady growth for a decade, we predict the decision in QBE will see significant growth in domestic and foreign funders launching Australian class action claims in 2017.

The ‘common fund’ doctrine approved by the Full Federal Court permits funders to spread the costs of prosecuting a class action across the entire group, and extract a funding commission from the recovery of every group member, whether or not they have signed a funding agreement. The effect is that class actions will become more economically attractive to funders. This is because they can now extract a commercial return across the entire ‘open’ class, rather than being limited to recovery from the small subset of group members who sign-up with the funder.

Expect more funders in our market and larger claims as a result.

2. More claims covering new territory

More funders – and plaintiffs law firms – pursing more opportunities in our market means class action promoters will be increasingly searching for market share and new types of cases to expand their practice.

For the shareholder class action environment, this will mean more actions against small to mid-cap listed companies (historically overlooked by larger funders and plaintiffs firms).

More generally it will mean funders exploring new types of class action cases not presently exploited. We expect to see the emergence of pollution and environmental toxic torts claims, more claims in the education, consumer and mining sectors, a growing risk of class actions relating to climate change, and a spike in IPO claims in a supressed investment market.

3. Push for contingency fees

With the fillip to third party funding delivered by the approval of the ‘common fund’ doctrine, we predict plaintiffs will revive their calls for contingency fees to be introduced for class actions. The Productivity Commission has already recommended the introduction of contingency fees in Australia and similar fee structures are now available in the UK.

With the increasing political and judicial momentum behind improving access to justice, we may see one or two Australian States break rank and amend their legal professional rules to permit lawyers to charge a percentage of the recovery obtained by their clients. This would almost certainly deepen the class action market, with more lawyers incentivised to pursue collective redress in the hope of larger returns, especially if costs risk can be spread across a portfolio of class actions (as funders currently do).

4. A fresh debate about the regulation of funding

Australia is close to a perfect environment for litigation funders. We arguably have the common law world’s strictest consumer protection and product liability laws; a demanding continuous disclosure obligation on listed entities; one of the largest proportions of adult share ownership in the world; a class action regime regarded around the world as ‘plaintiff friendly’ and little to no specific regulation of third party funding of class action litigation.

Add to this the bonus to funders following the Court’s approval of the ‘common fund’ doctrine, and Australia is the most attractive jurisdiction for class action funding in the world. With funders overseeing massive transfers of class action monies each year, expect fresh calls for stricter regulatory requirements for funders. This will include a push for minimum prudential requirements and restrictions on the level of control funders have over class actions and the size of commissions they can charge.

5. Greater risk for Australian business

More frequent class action claims, higher quantum of claims and a wider spectrum of subject matter will combine to heighten class action risk for Australian businesses in 2017.

Class action risk will not be limited to particular sectors or jurisdictions as our market deepens and diversifies. Boards will be well advised to proactively conduct a class action ‘vulnerability assessment’ across its businesses and regions.

Companies would also be wise to establish preventative and reactive responses to class action risk.

This should include reviews of:

- current areas of their business where class action risk might arise;

- refreshing and updating continuous disclosure protocols;

- revising product remediation and recall plans;

- checking insurance coverage for class action risk; and

- maintaining document collation and retention policies designed to accommodate responding to class action threat

Key contacts

Ante Golem

Partner and Joint Global Head of Construction & Infrastructure Disputes, Perth

Legal Notice

The contents of this publication are for reference purposes only and may not be current as at the date of accessing this publication. They do not constitute legal advice and should not be relied upon as such. Specific legal advice about your specific circumstances should always be sought separately before taking any action based on this publication.

© Herbert Smith Freehills 2024