Herbert Smith Freehills has cemented its reputation as the powerhouse in Australian M&A after topping all three of the region’s M&A legal advisor league tables for the 2017 calendar year.

Herbert Smith Freehills advised on significantly more M&A transactions in Australia and New Zealand in 2017 than any other firm, ranking:

- 1st by value and deal count in both announced and completed deals - Australia and New Zealand (Thomson Reuters M&A Review 2017)

- 1st by value and deal count in announced deals - Australia and New Zealand (Bloomberg Global M&A Review 2017)

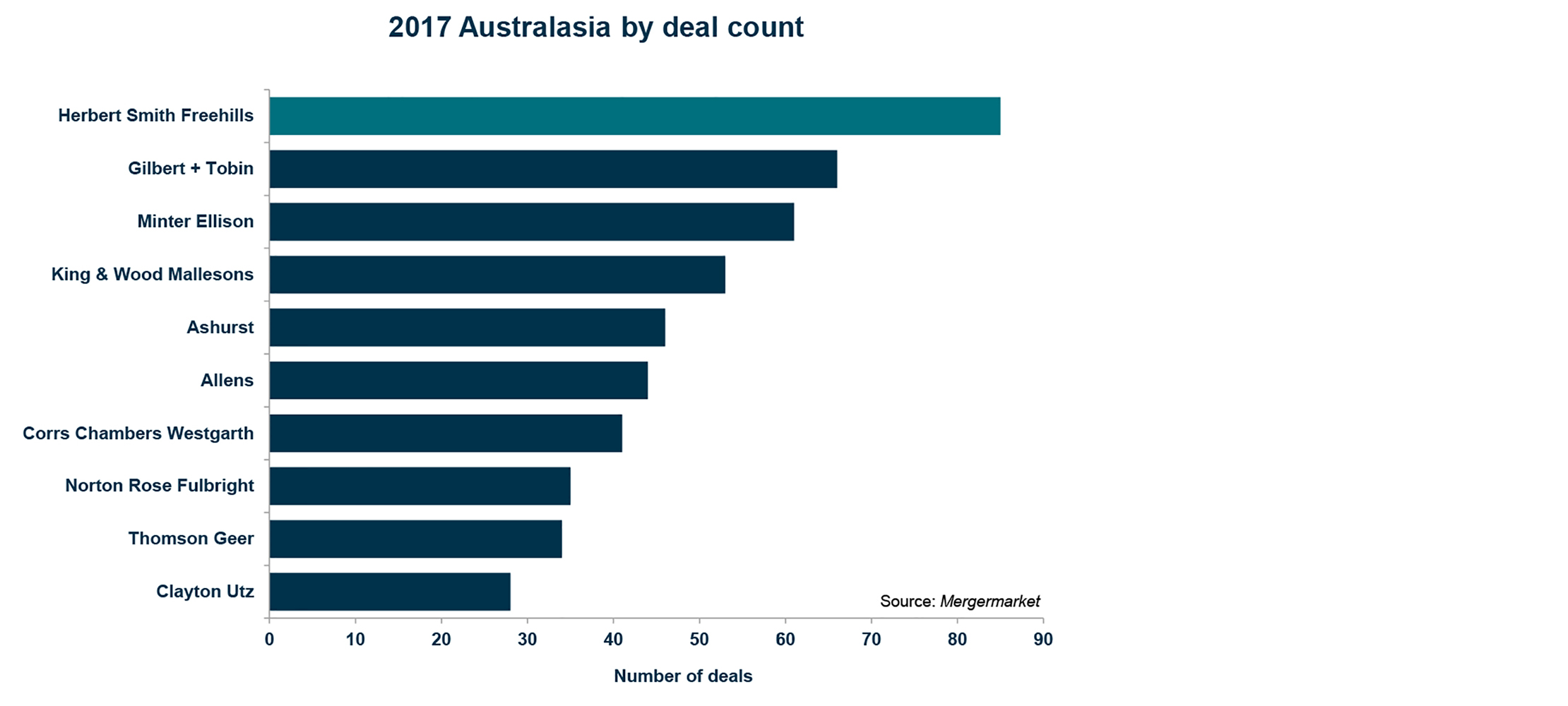

- 1st by value and deal count - Australasia (Mergermarket M&A Report Q4 2017)

These exceptional results follow the firm’s domination of Australian M&A league tables for many years and confirm Herbert Smith Freehills as the clear and undisputed market leader for M&A in Australia, a position which has been built on the exceptional quality, depth and experience of the firm’s M&A team and their commitment to clients.

2017 was a healthy year for M&A in the Asia Pacific region.

According to Bloomberg, M&A activity targeting the APAC region in 2017 increased by 14.2% year on year to US$1 trillion. Private equity deals in the region increased by 27.5% year on year to US$210.5 billion – the highest historical volume to date.

In another report, Mergermarket has revealed that Australia was the most targeted nation in the Asia Pacific region in terms of both inbound deal count and value with 176 deals worth a combined total of US$41b. Herbert Smith Freehills advised on almost half of those transactions.

Herbert Smith Freehills partner Raji Azzam commented: “The market performed well last year, particularly in the last quarter, where a flurry of activity in the lead up to Christmas included some significant mega deals, such as the Westfield transaction. This bodes well for a solid year of deal making in 2018. In fact, there are already a number of significant deals in the pipeline and we are seeing a higher degree of confidence in boardrooms.

“Low unemployment rates, low interest rates and the continued availability of capital continue to make Australia a highly attractive investment destination for international acquirers.

“Looking forward, I would expect to see more public markets transactions, particularly from Private Equity houses. There is a significant amount of liquidity in the market including from some new funds both in Australia and the broader Asian region who will be looking to deploy capital in the coming months.”

Partner Adam Strauss added: “Looking at sectors, infrastructure will continue to perform well in 2018 along with the mining and resources sector. Commodity prices rebounded in 2017 and have remained relatively strong, which has seen confidence rebound and will drive continued deal making.

“In 2017 we also saw a considerable amount of activity in the financial services sector and I expect that to continue as structural and regulatory reviews slated for the banking sector in 2018 could drive even more activity. More generally, boards of ASX listed companies remain under pressure to streamline and divest underperforming or non-core businesses and I think this will also be a driver for M&A in 2018.”

“Conditions are ripe for companies across a range of sectors to carry out their strategic plans. We’re looking forward to a busy year ahead.”

Herbert Smith Freehills acted on some of the country’s most complex and strategic corporate transactions in 2017, including advising:

- Tabcorp on its A$11b merger with Tatts, including dealing with the ACCC, acting in proceedings before the Australian Competition Tribunal (and Federal Court judicial review proceedings) and providing M&A advice - largest gambling industry merger ever in Australia

- Fairfax Media in relation to indicative proposals received from a TPG-led consortium and separately, Hellman & Friedman.

- Yancoal Australia on its acquisition of Rio Tinto’s A$3.2 billion stake in Coal & Allied Industries.

- Aconex Limited on its A$1.6 billion sale to Oracle.

- CBA on its $3.8 billion life insurance sale.