On 7 December 2017, the Australian Government took a further step towards whistleblower reform by introducing the Treasury Laws Amendment (Enhancing Whistleblower Protections) Bill 2017 into the Senate (Whistleblower Bill).

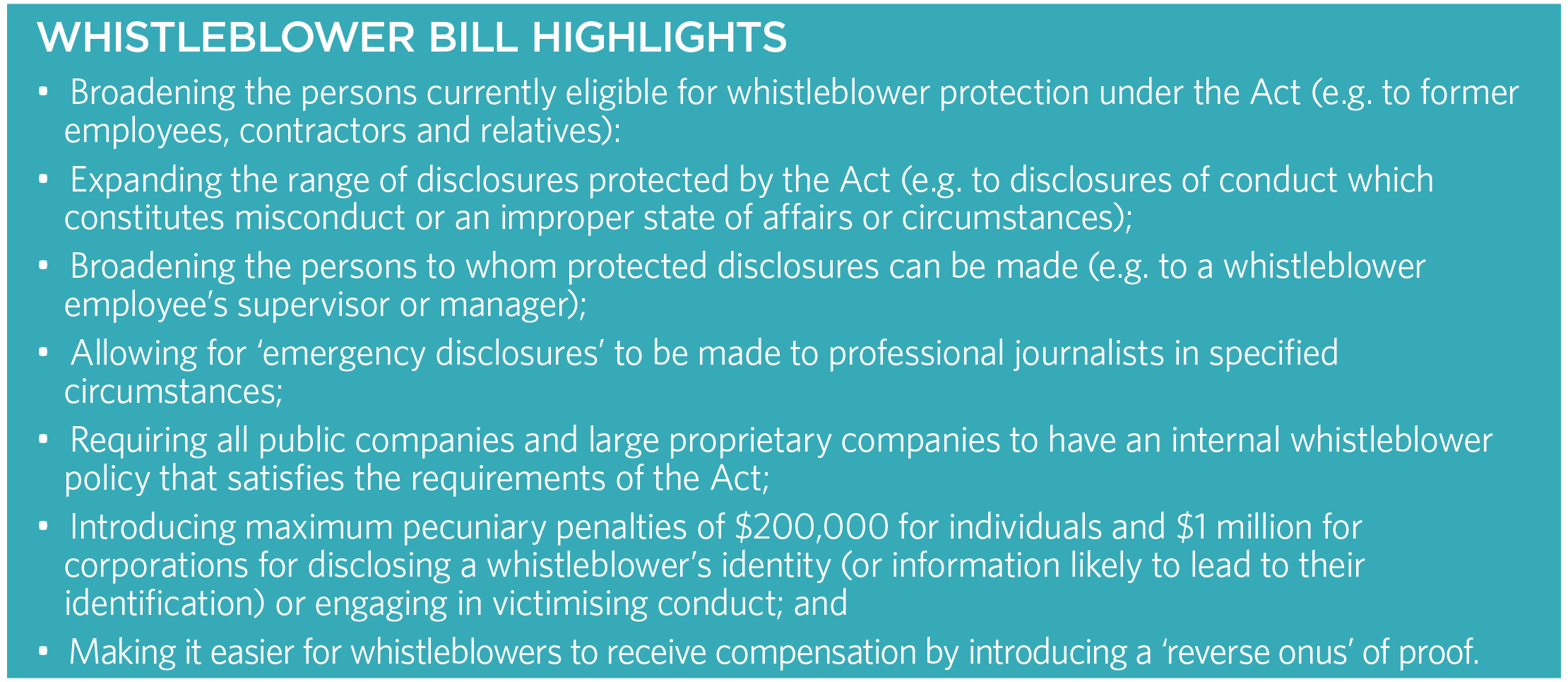

The Whistleblower Bill seeks to consolidate whistleblower protections in the corporate, financial and credit sectors into a single regime under the Corporations Act 2001 (Cth) (Act). A summary of the key features of the Whistleblower Bill is outlined in the table further below.

The Whistleblower Bill followed the release of exposure draft legislation (Exposure Draft) for public consultation on 23 October 2017. Please see here for our article on the Exposure Draft.

The Whistleblower Bill is intended to be effective from 1 July 2018. However, it is proposed that organisations will have until 1 January 2019 to introduce a whistleblower policy that complies with the specific requirements set out in the Whistleblower Bill.

Issues which have been addressed

We are pleased to see that the Whistleblower Bill addresses a number of the issues raised in our submission to Treasury (Submission) in response to the Exposure Draft. These include our submissions that:

- Legal advice: a person should be permitted to obtain legal advice from a legal practitioner in relation to a whistleblower disclosure, without having to first obtain the whistleblower’s consent. Under the Exposure Draft, a failure to obtain such consent before seeking legal advice would have amounted to a breach of the confidentiality provisions, potentially resulting in maximum penalties of $200,000 for individuals and $1 million for a corporation. The Whistleblower Bill now expressly permits this;

- Investigation: further disclosure of a whistleblower disclosure should be permitted in order for an internal investigation to be undertaken, without first having to obtain the whistleblower’s consent. Under the Exposure Draft, in the absence of such consent, it would have been practically difficult for a corporation to investigate a disclosure without contravening the confidentiality provisions. The Whistleblower Bill now expressly permits further disclosure where reasonably necessary for the purposes of an investigation, provided the whistleblower’s identity is not disclosed and all reasonable steps are taken to reduce the risk they will be identified; and

- Whistleblower policy: clarification be provided as to how a company could practically meet the requirement to make available a compliant whistleblower policy to all categories of eligible whistleblowers, noting such categories extended to employees of contractors, associates of corporations and spouses, children and dependents of whistleblowers. The Whistleblower Bill now only requires a whistleblower policy to be made available to officers and employees of captured entities (i.e. public companies and large proprietary companies).

Unresolved issues

Regretfully, there are a number of issues raised in our Submission which have not been addressed in the Whistleblower Bill. These include our submissions that:

- Reverse onus of proof: the ‘reverse onus’ of proof proposed to be placed on respondents in compensation proceedings for victimisation be removed, in order to reduce the risk of unmeritorious claims being brought. This ‘reverse onus’ is contrary to the basic principle of the Australian adversarial legal system that ‘he who asserts must prove’, as it shifts the burden of proof onto a respondent to prove that they did not victimise a whistleblower. Regretfully the Whistleblower Bill has taken this concept a step further and now only requires a claimant to show that there was a “reasonable possibility” of victimising conduct in order to activate the ‘reverse onus’;

- Reasonable management action defence: victimisation claims should be subject to a defence of reasonable management action, similar to the “bullying” regime under the Fair Work Act 2009 (Cth) and workers compensation legislation (and, in fact, certain public sector whistleblowing legislation). This was to address our experience that misguided or tactical victimisation-style claims are often made by individuals who have merely been the subject of reasonable management action. Whilst this submission has not been adopted, we are pleased to see that a defence is now available to employers in victimisation proceedings in relation to victimising conduct on the part of their employees, where they can establish they took reasonable precautions and exercised due diligence to avoid the victimising conduct by such employees;

- Journalists: professional journalists should not be included in the ‘emergency disclosure’ provision on the basis that, whilst they will endeavour to proceed with integrity and fairness, the media will always have an inherent vested interest in publishing information in a manner which is sensationalised. Our alternative submission – that a whistleblower should be required to make a disclosure to the relevant organisation internally (as opposed to, or in addition to, a regulator) before they make a disclosure to the media – has also not been addressed. This means that organisations may not have an opportunity to investigate or address the matters the subject of a disclosure before they are published in the media; and

- Cost protection: the cost protection extended to claimants (i.e. that they only be liable to pay a respondent’s legal costs where they institute proceedings vexatiously or unreasonably, or otherwise act unreasonably) be extended to respondents, so there is not an uneven playing field and in order to reduce the risk of a proliferation of unmeritorious claims. This has not been accepted.

We are hopeful that consideration will be given to these unresolved submissions as the Bill proceeds through Parliament to the House of Representatives. As both the Senate and House of Representatives are closed over the Christmas period, we expect that the Whistleblower Bill will sit in Parliament until the Houses reconvene in February 2018.

Key features of the Whistleblower Bill

Whilst not exhaustive, set out below are the key features of the Whistleblower Bill:

| Eligible whistleblowers |

Eligible whistleblowers will now include current and former:

|

| Protected disclosures |

Protected disclosures will now include disclosures where the whistleblower has reasonable grounds to suspect that the disclosed information:

|

| Good faith not required | It will no longer be necessary for the whistleblower to make their disclosure ‘in good faith’ in order to qualify for the protections. |

| Anonymous disclosures | There is no longer a requirement for a whistleblower to disclose their identity in order to receive the protections. |

| Who can disclosures be made to? |

In addition to ASIC, APRA and other Commonwealth bodies (prescribed by regulations), disclosures may be made within a corporation to:

|

| Emergency disclosure to journalists and members of parliament |

The proposed whistleblower regime provides for an ‘emergency disclosure’ to a member of Parliament or professional journalists in specified circumstances, including where:

|

| Confidentiality |

The whistleblower’s identity, or information which is likely to lead to their identification, must remain confidential, unless such information is disclosed to ASIC, APRA, a member of the AFP, a legal practitioner, another prescribed person or otherwise with the consent of the discloser. A person will not breach this requirement if the disclosure is reasonably necessary for the purposes of investigating a protected disclosure, the identity of the whistleblower is not disclosed, and they take all reasonable steps to reduce the risk the whistleblower will be identified. A breach of this requirement can result in maximum pecuniary penalties of $200,000 for individuals and $1 million for corporations. |

| Detriment suffered by whistleblowers |

Broader types of detriment which may be suffered by whistleblowers have been specified, which include (without limitation):

|

| Compensation |

Compensation may be awarded where:

A “reverse onus” applies in that, provided the claimant in compensation proceedings has adduced evidence which suggests a “reasonable possibility” of victimising conduct, the respondent bears the onus of providing that the claim is not made out. Where a court is satisfied that a person has engaged in victimising conduct, they may be required to compensate the victim for any loss, damage or injury suffered as a result, noting maximum pecuniary penalties of up to $200,000 for individuals and $1 million for corporations apply. The court may also order other remedies, including an injunction, apology, reinstatement of an employee to their employment, payment of exemplary damages, or any other order the court thinks appropriate. Claimants will not be ordered to pay costs unless the court is satisfied that they instituted the proceedings vexatiously or without reasonable cause, or there was an unreasonable act or omission on their part that caused the respondent to incur the costs. |

| Whistleblower policy | Public and large proprietary companies must have a whistleblower policy that sets out the matters referred to in the legislation and make that policy available to officers and employees. |

If you would like more information, please contact one of our key team members below.

Key contacts

Legal Notice

The contents of this publication are for reference purposes only and may not be current as at the date of accessing this publication. They do not constitute legal advice and should not be relied upon as such. Specific legal advice about your specific circumstances should always be sought separately before taking any action based on this publication.

© Herbert Smith Freehills 2024