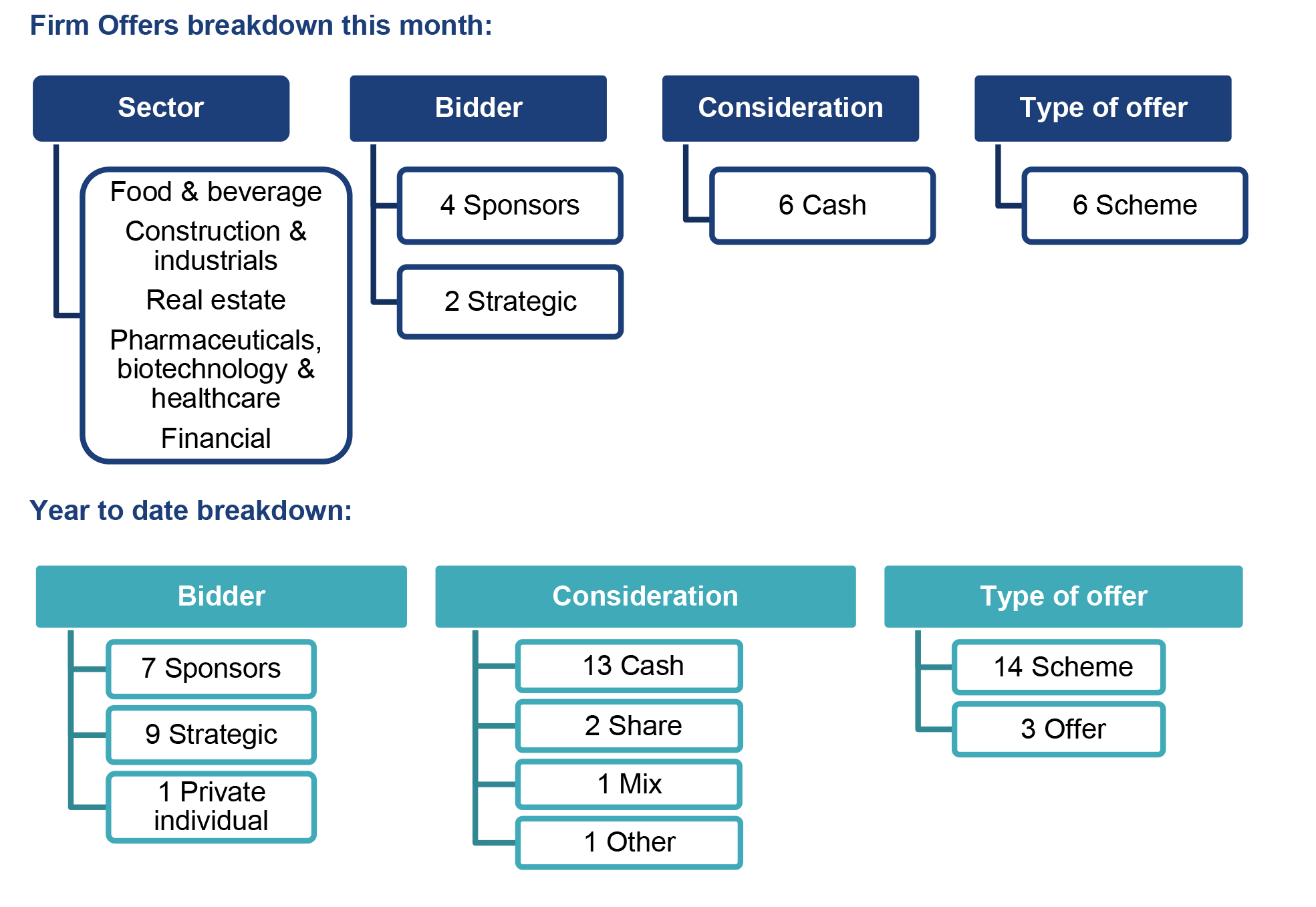

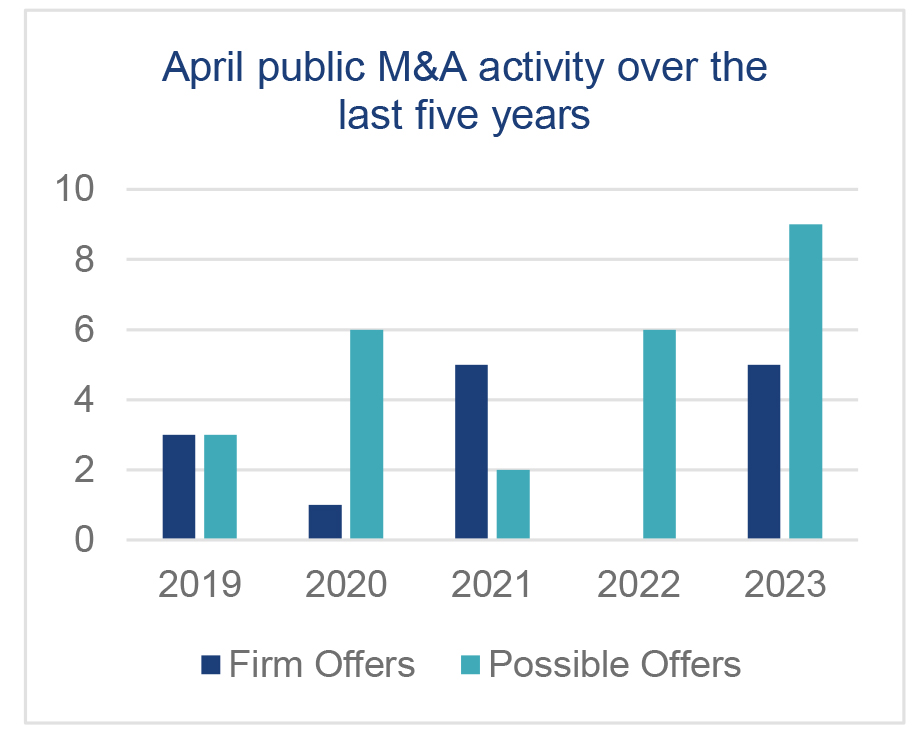

In April 2023, there were six Rule 2.7 announcements made across the UK public M&A market and a further nine possible offers announced.

Firm Offers announced this month:

- Recommended cash offer by TORIDOLL Holdings Corporation for The Fulham Shore plc - £93.4 million

- Recommended cash offer by BaltCap, Cogels Investments Limited and Nuoma IR Kapitalas for Xpediator plc - £62.34 million – public to private

- Recommended cash offer by Blackstone Inc. for Industrials REIT Limited - £511.2 million – public to private

- Recommended cash offer by Cap10 Partners LLP for Sureserve Group plc - £214.1 million – public to private

- Recommended cash offer by IK Investment Partners Limited for Medica Group plc - £269 million – public to private

- Recommended cash offer by Deutsche Bank AG for Numis Corporation Plc - £410 million

Possible Offers announced this month:

- Possible offer by Blackstone Inc. for Industrials REIT Limited - £498.73 million (subsequently announced a firm offer)

- Possible offer by ZQ Capital Management Limited for Allergy Therapeutics plc - £6.8 million

- Strategic review announced by The Black Sheep Brewery plc (withdrawn)

- Possible offer by EQT X EUR SCSp and EQT X USD SCSp for Dechra Pharmaceuticals PLC - £4.63 billion

- Possible offer by Apollo Global Management Inc. for THG plc

- Strategic review including formal sale process announced by Advanced Oncotherapy plc

- Possible offer by CVC Advisers Limited and Francisco Partners Management, L.P. for Network International Holdings plc - £2.06 billion (further possible offer subsequently announced)

- Possible offer by Brookfield Asset Management Limited for Network International Holdings plc - £2.13 billion (further possible offer previously announced)

- Possible offer by PEXA Group Limited for Smoove plc

April 2023 Updates:

Changes to the Takeover Code published

The Takeover Panel has published two response papers on the offer timetable in a competitive situation (RS 2022/3) and on miscellaneous amendments to the Code (RS 2022/4). The amendments to the Code will take effect on Monday, 22 May 2023, and will apply to all transactions from that date, including transactions that are already live.

The amendments are broadly as proposed in the consultation papers PCP 2022/3 and PCP 2022/4.

The offer timetable in a competitive situation (RS 2022/3)

In the new rules, the Panel has clarified how the offer timetable applies in certain competitive situations where one of the bidders is proceeding by way of scheme and official authorisations or regulatory clearances are required by one or both of the bidders:

- Official authorisation or regulatory clearance required – Where one or more official authorisations or regulatory clearances cannot be obtained in the normal 60-day timetable for contractual offers, the Panel will not normally introduce an auction procedure under Rule 32.5 until after the last condition relating to a relevant official authorisation or regulatory clearance has been satisfied or waived by each of the bidders.

- Bidder wishing to complete its offer prior to the introduction of an auction procedure – Where one bid is proceeding faster than another (in terms of obtaining the requisite clearances) and the faster bidder does not wish to wait for the other bidder to obtain its clearances and the subsequent Panel auction procedure before completing its bid:

- If the faster bidder is proceeding by way of contractual offer, it can make an acceleration statement and bring forward the unconditional date of its offer (provided it is willing to waive any outstanding conditions etc as required by Rule 31.5). Otherwise, its Day 60 will effectively be suspended (such that its offer will not lapse on its acceptance condition on the 60th day after publication of its offer document).

- If the faster bidder is proceeding by way of scheme (which has been approved by target shareholders) and the target board (with the agreement of the faster bidder) wishes to complete the scheme prior to the Panel auction procedure, the target board should consult the Panel as to whether the sanction of the scheme would, without an additional shareholder vote, be restricted by Rule 21.1 on frustrating action (although the Panel will generally agree to disapply Rule 21.1 in these circumstances).

- Setting Day 60 where there is a competing offer and scheme – Where one competing offer is by way of scheme and the other by way of a contractual offer, Day 60 on the contractual offer will normally be set for a date after the shareholder meetings and before the court sanction hearing in relation to the scheme.

Miscellaneous Code amendments (RS 2022/4)

This response statement contains a variety of minor amendments to the Code including the following:

- Companies in financial difficulty – The Panel will have greater flexibility to grant a derogation or waiver from the Code in exceptional circumstances, for example to facilitate a rescue of a company which is in serious financial difficulty.

- Rumour or speculation following a DTR 5 disclosure – Where a potential offeror is actively considering an offer, and there is rumour or speculation, or an untoward movement in the target’s share price, the potential offeror will have to make an announcement under Rule 2.2 of the Code, even if the rumour or speculation, or share price movement, is caused by a public statement such as a disclosure under DTR 5.

- Recommendations by the target board – The target board must make a recommendation to shareholders (and to holders of convertible securities, options and subscription rights) as to the action that they should take, and where there are alternative offers, the target board circular must state which alternative (if any) the directors intend to elect for in respect of their own shares (and why). Examples of language which a target board could use are set out in Appendix C of Response Statement 2022/4.

UK Public M&A Consolidated Update

We have published a consolidated update providing a brief overview of developments in recent months in respect of UK public M&A. The update includes an overview of recent market activity as well as the UK Takeover Code and other legal and regulatory developments including changes to presumptions on "acting in concert" under the Code, clarification on how the offer timetable applies in certain competitive situations and other miscellaneous Code changes, as well as the FCA's Primary Market Bulletin 44 on schemes of arrangement.

The consolidated update can be accessed here.

April 2023 Insights:Public M&A deal activity this April has almost doubled compared to previous years, with six firm offers and nine possible offers announced. There has been a surge in the number of possible offers this month. The possible offer by Blackstone Inc. for Industrials Reit Limited subsequently became a firm offer following an increase in the offer price, whilst Network International Holdings plc received two possible offers from different bidders. Overall, deal activity has been slow entering 2023, but this increase in activity may indicate that the appetite for public M&A is increasing. |

|

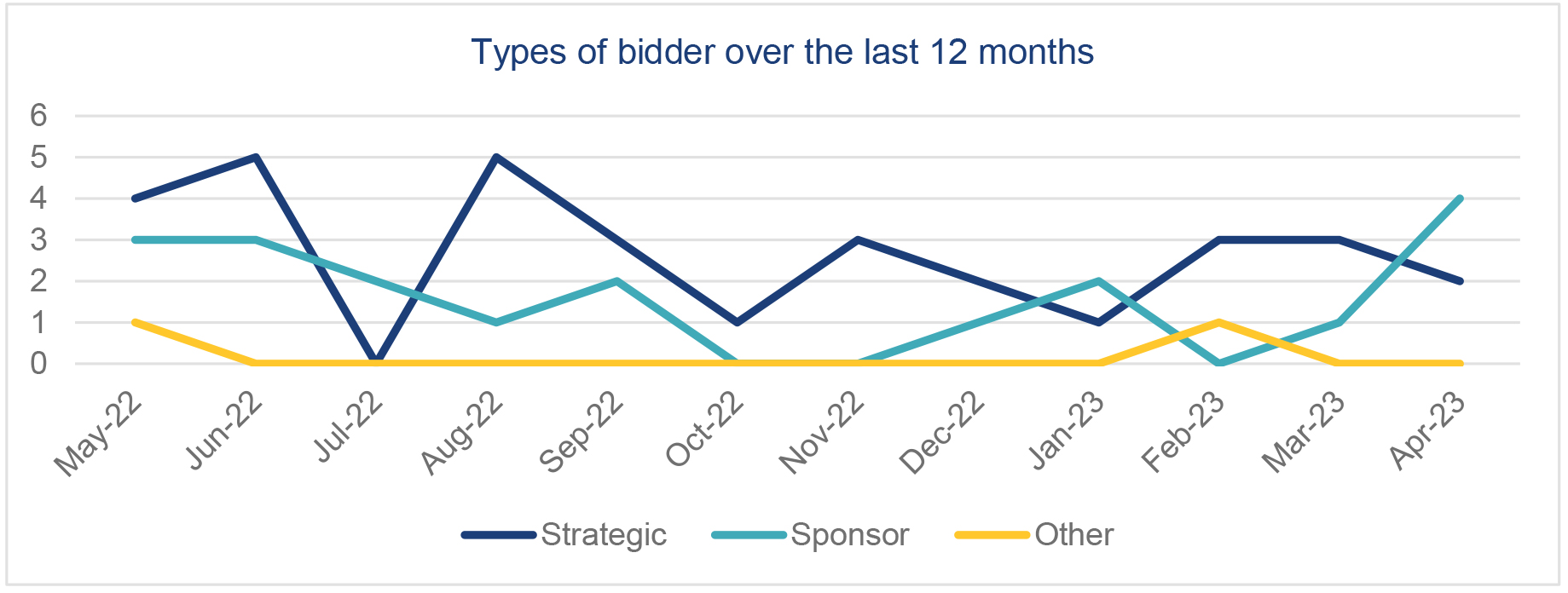

The majority of firm offers in April were made by sponsors (i.e. private equity bidders). With four sponsor bids, April 2023 saw the highest number of such bids in the last 12 months. Whilst strategic bidders acquire companies in the same industry, sponsor bidders are mostly private equity firms which see the target as an investment opportunity. Two of the sponsor bidders involve foreign companies. Overseas bidders have been targeting UK companies because of the low exchange rate – and are likely to continue to do so as they try to make the most of the pound's weakness. Interestingly, the offer for Xpediator plc by BaltCap, Cogels Investments Limited and Nuoma IR Kapitalas was planned by Xpediator's founder and former CEO, Stephen Blyth. Cogels Investments Limited is his investment vehicle and would own 40% of the company once it is taken private. The company has been underperforming following disruption related to Brexit and Covid-19. The consortium plans to resolve the company's operational and financial issues to accelerate the business's development.

Useful links

- Herbert Smith Freehills Takeovers Portal.

- Herbert Smith Freehills Public M&A Podcast Series.

- The Takeover Code.

- The Takeover Panel’s Disclosure Table (detailing offeree companies and offerors currently in an offer period).

Key contacts

Legal Notice

The contents of this publication are for reference purposes only and may not be current as at the date of accessing this publication. They do not constitute legal advice and should not be relied upon as such. Specific legal advice about your specific circumstances should always be sought separately before taking any action based on this publication.

© Herbert Smith Freehills 2024