In 2017 the Panel is delivering certainty by dealing with takeover disputes in a timely fashion. Our analysis shows that average days for the Takeovers Panel to make a decision has significantly declined in 2016/2017, and continues to decline further in calendar year 2017.

IN BRIEF

- The Takeovers Panel has more than halved the average time to make a decision on matters in 2017 compared against the average for the previous five year period.

- The Panel is progressing its core objective of delivering timely resolution to takeover disputes and certainty in control situations.

- What is driving this speed appears to be an increasingly pragmatic and decisive approach to determining matters, which we strongly encourage.

Our analysis shows that average days for the Takeovers Panel to make a decision on a matter has significantly declined in 2016/2017 and continues to decline further in calendar year 2017.

With greater speed and decisiveness in 2017, the Panel is progressing its core objective of delivering timely decisions to create certainty during takeovers.

THE TREND TOWARDS GREATER SPEED

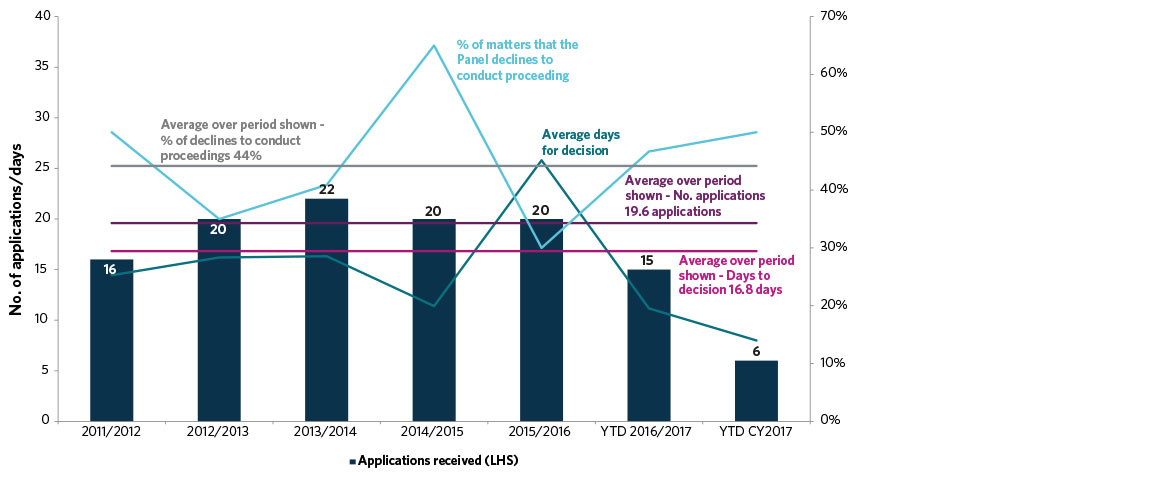

For the year to date 2016/2017, the Takeovers Panel has taken an average of 11.2 days to arrive at a decision from when an application was first made. Further, for the year to date calendar year 2017, it took the Takeovers Panel an average of only 8 days to arrive at a decision.

The year to date data compares favourably to the previous 5 year period, where it took an average of almost 17 days for a decision, effectively meaning the Panel has halved the average time it takes to resolve a matter.

The benefits of the timely resolution of matters by the Panel is clear, reducing the period of uncertainty for all stakeholders caused by such disputes.

In the chart below we have set out the data relating to the timeliness of Panel decision making over the last 6 years, as well as possible data sets that may contribute to such timeliness.

Analysis of timeliness in Takeovers Panel decision making

WHAT IS DRIVING THE PANEL’S TIMELINESS IN 2017?

The Panel’s speed does not appear to be caused by a decline in its workload. The number of applications received for 2016/2017 is broadly in line with the average from the preceding five years.

We have, however, observed a direct correlation between the percentage of matters in which the Panel declined to conduct proceedings and the greater speed of decision during the last 12 months. In 2016/2017 the Panel has declined to conduct proceedings in 47% of applications and in calendar year 2017 that percentage went up to 50%, both up from 2015/2016 where it was 30% of matters.

The question becomes: this year has the Panel received a greater number of straight forward matters (where there was no reasonable prospect that it would find unacceptable circumstances) or is there a renewed push for decisiveness within the Panel?

An analysis of two recent matters suggests greater decisiveness by the Panel may be driving this efficiency.

Innate Immunotherapeutics

In January 2017, the Panel received an application in respect of an alleged association between shareholders in Innate Immunotherapeutics that would have led to a breach of the 20% rule.

The applicant had submitted that there was an available inference that one key shareholder, Mr Christopher Collins, was associated with two of his adult children who held shares and also with certain other shareholders who had business and personal relationships with Mr Collins.

Within just 5 days of receiving the application, the Panel concluded that the applicant had provided insufficient material to justify further enquiries into the alleged association and declined to hear the matter.

The Panel took a pragmatic approach to the circumstances. It concluded:

- while a family relationship is a possible indicator of an association, there was material suggesting independence in this case and overall there was insufficient material to support the finding of an association; and

- shareholders were informed of the relationship between Mr Collins and his children and a significant period had elapsed since that disclosure with no challenge having been made.

The Panel also queried the motivations for the application, given the application had been leaked to the media on the day it was made. This, together with the small number of shares held by the applicant, gave rise to a broader question of whether the applicant had standing for the matter to be heard.

Macmahon Holdings

In March 2017, CIMIC applied to the Panel claiming that Macmahon’s target’s statement in response to CIMIC’s bid was misleading and deceptive.

CIMIC sought orders for correction of the disclosure, but also that on-market purchases of Macmahon shares since the release of the target’s statement be rescinded.

The Panel was swift in its response, declining to conduct proceedings one day after the application was received. Nevertheless, the Panel systematically dealt with the disclosure concerns raised by CIMIC and found that, while the disclosure by Machmahon could have been better, it was not materially misleading.

In deciding not to conduct proceedings, the Panel also had regard to the fact that CIMIC’s offer was final and not capable of being extended. This was significant for two reasons:

- the CIMIC offer was to end on 9 March 2017. Given the application was made on 6 March 2017, there was insufficient time for shareholders to consider and respond to any decision the Panel may make in respect of the need for revised disclosure; and

- given the level of support received by the final CIMIC offer, it was unlikely that corrective disclosure at this late stage would be material to shareholders’ decision to accept the CIMIC bid.

Although the Panel systematically dealt with the disclosure concerns raised by CIMIC, the matter was dealt with quickly in part due to the practical realities of taking longer to make a decision in the circumstances.

COMMENTARY

We encourage the Takeovers Panel’s progress in 2017 in delivering faster and more certain outcomes in the matters before it.

The Innate Immunotherapeutics and Macmahon Holdings matters show the Panel’s efficiency is being driven by a greater focus on pragmatism and decisiveness.

We believe this is a positive development for control situations, reducing the ambiguity and disruption that would be caused by disputes that are allowed to continue for extended periods.

Legal Notice

The contents of this publication are for reference purposes only and may not be current as at the date of accessing this publication. They do not constitute legal advice and should not be relied upon as such. Specific legal advice about your specific circumstances should always be sought separately before taking any action based on this publication.

© Herbert Smith Freehills 2024