The new regulations and instrument giving effect to the revised SIV programme have been published and are substantially similar to the draft framework published in May 2015.

In brief

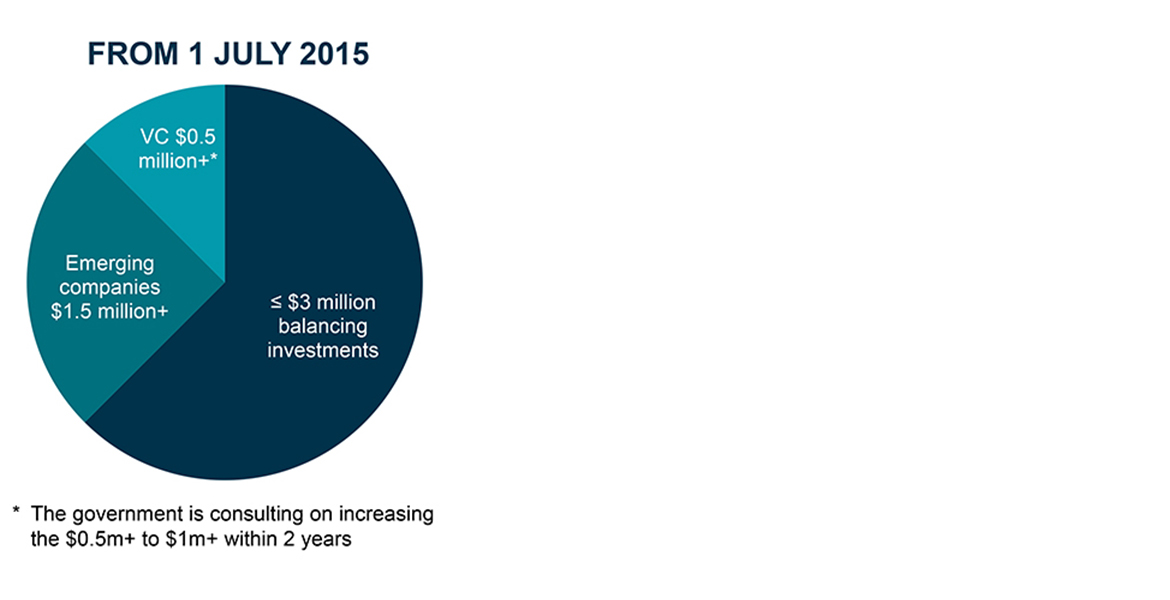

- The new investment criteria for the SIV regime apply for a SIV visa application lodged on or after 1 July 2015 and include allocations of:

- at least $0.5 million to venture capital,

- at least $1.5 million to emerging companies, and

- up to $3 million in one or more balancing investments.

What’s happened to the SIV & PIV programmes?

On 29 and 30 June respectively, the Australian government released the Migration Amendment (Investor Visas) Regulation 20151 and the Migration (IMMI 15/100: Complying Investments) Instrument 20152 (together the New Framework) which amend the significant investor visa (SIV) programme and introduce the premium investor visa (PIV) programme. This article addresses the SIV programme changes and does not address the PIV programme.

The New Framework largely reflects the draft framework published by Austrade on 15 May 20153 (Draft Framework).

The New Framework commenced on 1 July 2015. This means that the new SIV programme rules apply to persons lodging a SIV visa application on or after 1 July 2015.

Is grandfathering available?

Yes, persons who lodged a SIV visa application before 1 July 2015 (in effect those who applied before 24 April 2015, at which time applications were suspended pending the introduction of the New Framework) are grandfathered under the former SIV programme rules.

This means that those early applicants are not required to invest in venture capital or emerging companies and have a slightly broader range of permitted investments.

The eligibility for grandfathering turns on the timing of the application for the SIV visa, not the timing of the nomination following an EOI (as had been previously indicated).

What does this mean for existing SIV fund managers and trustees?

Managers and trustees of funds which were established to provide eligible investments for SIV applicants under the former SIV programme rules will, in practice, only be able to take new applications from early SIV applicants ‘switching’ to their fund. They will need to continue to monitor compliance with the former SIV programme rules (not the new balancing investment criteria under the New Framework) and to issue forms 1413.

Fund managers may consider establishing a new fund or platform for new SIV applicants which provides access to eligible investments under the New Framework.

What is the structure of the new SIV programme?

The allocation of the $5 million SIV investment between the eligible venture capital funds (VC), emerging companies and the balancing investments is as detailed in the Draft Framework, shown in the following chart:

In order to manage this allocation across the three classes of investment, investors can invest in a fund of funds, platform or IDPS, or can invest in a series of complying funds.

The New Framework provides for the following minimum standards in relation to issuers and managers of complying investments:

- they must have an Australian financial services licence or hold a relevant AFSL exemption,

- they must be independent of the SIV applicant or the applicant’s spouse or de facto partner, and

- their central management and control must be in Australia (this third requirement was not in the Draft Framework).

Additionally, issuers (other than VC general partners) must maintain a minimum of $100 million in funds under management in Australia. In the Draft Framework this $100 million requirement related to firm wide (not just Australian) funds under management for managers of the emerging companies investments and balancing investments unless the responsible entities of those investments met this criteria.

Under the New Framework issuers and managers are no longer required to provide a form 1413 but are required to provide ‘evidence’ that the investment is a ‘complying significant investment’ under the New Framework. Guidance is expected to be provided by the government in due course in relation to the form and content of this evidence.

Complying investments for both the balancing investments and the emerging companies components are subject to the following limitations identified in the Draft Framework:

- derivatives may only be used for risk management purposes, up to any amount; and

- cash may be held with an Australian ADI up to a 20% limit.

What are the requirements of the VC investment?

Consistent with the Draft Framework, at least $500,000 must be invested in VC. Austrade has indicated that this amount may be increased to at least $1 million within 2 years, subject to industry consultation.

A VC for this purpose needs to be a partnership or fund conditionally or unconditionally registered under the Venture Capital Act 2002.

The subtle differences between the detail of the VC component in the Draft Framework and the New Framework are outlined below.

| Draft Framework VC investment | VC requirements under the New Framework |

|---|---|

| proof that funds are taken upfront by the fund vehicle (or held in escrow in a CMT or bank account as security) | funds must be held in escrow in favour of the general partner or as security for a guarantee issued by an Australian ADI within 12 months from the date the SIV is granted |

| proof of entering into a commitment with the fund within 12 months from the date the provisional visa is granted | investor must enter into an agreement with the general partner to commit to the investment within 12 months from the date the SIV is granted |

| proof that VC fund investments must have commenced within 4 years from the date the visa is granted | a ‘substantial part’ of the investment must be invested during the period of the SIV |

The New Framework also provides clarity surrounding changes to the VC investment:

- If the VC investment is realised before the SIV ceases, the realised funds must be reinvested in either a compliant VC, emerging company or balancing investment within 30 days.

- If the VC investment lapses, the funds must be reinvested in another complying VC within 30 days.

What are the parameters of the emerging companies investments?

There are no substantial changes between the parameters for the $1.5 million investment in emerging companies published in the Draft Framework and the New Framework.

In the event that any of the limits are breached, the fund manager has 10 business days from the date that the breach occurred, to remedy the breach until the investment is classified as non-compliant. Issuers and managers need to put compliance arrangements in place to monitor this compliance as this 10 business day period commences on the occurrence of a breach, not on becoming aware of the breach.

If the investment is non-compliant, an investor has 30 days to switch funds to another complying emerging companies investment.

Only unlisted managed funds and listed investment companies are eligible, but exchange traded funds are not eligible.

What are the balancing investments?

The balance of the $5 million SIV investment must be invested in one or more ‘balancing investments’ through a managed investment fund (namely an unlisted managed investment scheme, a listed investment company or certain insurance funds regulated under the Life Insurance Act 1995) as identified in the Draft Framework.

The New Framework clarifies that the investment grade bonds/notes may be issued by a registered foreign company.

Endnotes

Legal Notice

The contents of this publication are for reference purposes only and may not be current as at the date of accessing this publication. They do not constitute legal advice and should not be relied upon as such. Specific legal advice about your specific circumstances should always be sought separately before taking any action based on this publication.

© Herbert Smith Freehills 2024