In the post-sanctions era, Iran is emerging as an exciting destination for foreign direct investment. After decades of isolation from international markets, and with constant growing demand domestically in all sectors, the country is keen to attract overseas investors to compensate for its under-development in recent years.

Despite its focus on the development hydrocarbon sector, Iranian lawmakers have prioritised the reduction of CO2 emissions and the development of renewable energy resources as key goals within the framework of the fifth five-year development plan - with a target of 5000 MW of installed capacity from renewable power plants in the short term. In the long term, the Iranian Government (the "Government") hopes to increase the nominal capacity of all power plants from 74 GW to over 120 GW by the end of 2025, with a substantial portion of this to be derived from renewable resources.

This is unsurprising given that Iran has substantial potential for renewable energy resources. The average solar radiation in Iran is 4.5 to 5.5 kW h/m2, and the country benefits from 300 days of sunshine per year over two-thirds of its land area. A country-wide assessment shows that on 80% of the land in Iran’s territory, the solar irradiation would be between 1640 to 1970 kWh/m2 per year. Moreover, the wind energy potential is estimated to be 30000 MWh.

In order to drive the country's growth in the is sector, the Renewable Energy Organization of Iran ("SUNA") was established in 1996 to evaluate the county's renewable energy potential, to implement renewable energy projects, and to guarantee the purchase of any electricity generated in order to attract private sector participation in this field. Today, SUNA is [part of the Ministry of Energy] and tasked with all matters relating to renewable energy.

The Government is now seeking to capitalise on its vast potential by bringing in further private investment and is therefore offering substantial incentives for such private investors. These advantages and incentives include:

- A power purchase agreement ("PPA") which guarantees electricity offtake for 20 years;

- A letter of credit in Rials from an Iranian bank equal to payments at six-monthly intervals under the PPA;

- Financial support from the Government via interest subsidies;

- The possibility to adjust the offtake tariff to neutralise local inflation and fluctuation in currency rates;

- Upon expiry of the PPA, the investor has the option to sell the electricity within the country to third parties, on the energy exchange market or any other method acceptable to the Ministry of Energy;

- In order to promote domestication and local manufacturing of clean and renewable power plants, the purchase price from power plants constructed with equipment manufactured using domestic design and workmanship will be increased by up to 15% proportionately;

- For the power plants connected to the distribution grid, subject to article 4 of the Economic Council Directive, 148 Rials per KW/h will be added to the offtake price as a transmission service fee.

Within this framework, SUNA provides a model PPA to be entered into with the private investor. Even though the model PPA needs certain improvements to ensure its bankability and in particular the incorporation of robust change in law provisions, arbitration as the dispute resolution mechanism, and indemnification in case of early termination, it still constitutes an important step towards understanding the international market.

SUNA recently adjusted the guaranteed offtake tariffs as follow:

IRAN - ELECTRICITY PURCHASE TARIFF - CONVERSION (IRR IN USD)

| Technology type | Applicable guaranteed electricity purchase tariff (2016) | Former guaranteed electricity purchase tariff (2015 | |||

|---|---|---|---|---|---|

| IRRs per KWh | USD¢ per KWh | IRRs per KWh | USD¢ per KWh | ||

| Wind farm | Above 50 megawatt capacity* | 3400 | 11.1 | 4060 | 13.3 |

| With the capacity of 50 megawatt and less | 4200 | 13.8 | 4970 | 16.3 | |

| Solar farm | Above 30 megawatt capacity* | 3200 | 10.5 | 5600 | 18.4 |

| With the capacity of 30 megawatt and less | 4000 | 13.1 | 5600 | 18.4 | |

| With the capacity of 10 megawatt and less | 4900 | 16.1 | 6750 | 22.2 | |

Exchange rate of USD = IRR30,360 (14 May 2016)

The guaranteed tariffs are less favourable than the 2015 guaranteed tariffs. The decrease is very aggressive and will place the Iranian market in line with the regional market and in competition with, for example, Jordan or Egypt.

These tariffs are applicable if the commissioning occurs within 18 months from the execution date of the PPA. For geothermal and biomass power plants, this period can be extended up to nine months. In case of a delay in commissioning, the purchase price will be the latest tariff announced by the Ministry of Energy at the time of commissioning of the power plant.

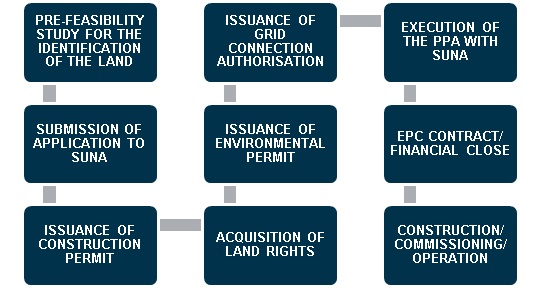

Even though SUNA is making impressive efforts to facilitate and standardise the development of renewable energy projects, there are currently limited precedents available. According to the officials and based on the few projects that do exist, the development of a renewable energy project is undertaken as follows:

Protection of foreign investments

Subject to the satisfaction of the conditions set therein, the foreign investor developing a renewable energy project may enjoy certain protections provided under the Foreign Investment Promotion and Protection Act ("FIPPA") which is the main legislation for the protection of foreign investments. In accordance with FIPPA, foreign investors are defined as non-Iranian naturals and/or legal persons or Iranians using capital with foreign origin, who have obtained the FIPPA investment licence.

Issuance of the investment licence is subject to fulfilment of the requirement that the foreign investment should contribute to economic growth, upgrade technology, enhance the quality of products, and contribute to an increase in employment, opportunities and exports.

Foreign investments fulfilling the criteria set out in the FIPPA are guaranteed the same rights, protections and facilities as those available to local investments. Protection against expropriation or nationalisation is guaranteed, unless in the "public interest", by means of a due legal process, in a non-discriminatory manner and in exchange for payment of appropriate compensation on the basis of real value of the investment immediately before the expropriation decision is taken.

The profit derived from the foreign investment can be transferred abroad after deduction of taxes, dues and statutory reserves and upon the approval of the Foreign Investment Board and confirmation of the Minister of Economic Affairs and Finance. Furthermore, the issue of entry visas, residence and work permits for foreign personnel is facilitated by the FIPPA.

Any disputes arising between the Government and foreign investors in relation to their mutual obligations under FIPPA are subject to the jurisdiction of Iranian courts, unless another dispute resolution mechanism is available through a bilateral investment treaty with the relevant government of the home jurisdiction of the foreign investor.

Legal Notice

The contents of this publication are for reference purposes only and may not be current as at the date of accessing this publication. They do not constitute legal advice and should not be relied upon as such. Specific legal advice about your specific circumstances should always be sought separately before taking any action based on this publication.

© Herbert Smith Freehills 2024