Indonesia’s New Investment List opens a number of sectors to foreign investment from 4 March.

The number of sectors subject to foreign ownership restriction on its face appears to have been significantly reduced. However, given the complexity of the relevant regulations in the context of the broader law reforms introduced by the Omnibus Law, the new rules do require careful analysis, particularly of any sector-specific legislation which may remain applicable.

The broad background of the changes is explained below, with sector-specific bulletins to follow.

Legislative background

The Indonesian government has finally published the long-awaited new investment list, under Presidential Regulation No. 10 of 2021 regarding Investment Sectors (the New Investment List).

The New Investment List is a key implementing regulation for Law No. 11 of 2020 regarding Job Creation (the Omnibus Law), which revised Indonesia’s Investment Law, Law No. 25 of 2007 (the Investment Law), among others. For more detail on the Omnibus Law, read our October 2020 bulletin here.

The New Investment List comes into effect on 4 March 2021, 30 days after it was promulgated, at which time Presidential Regulation No. 76 of 2007 (on the criteria to determine investment business lines) and Presidential Regulation No. 44 of 2016 (known as the 2016 Negative List) will be revoked.

Architecture of the New Investment List

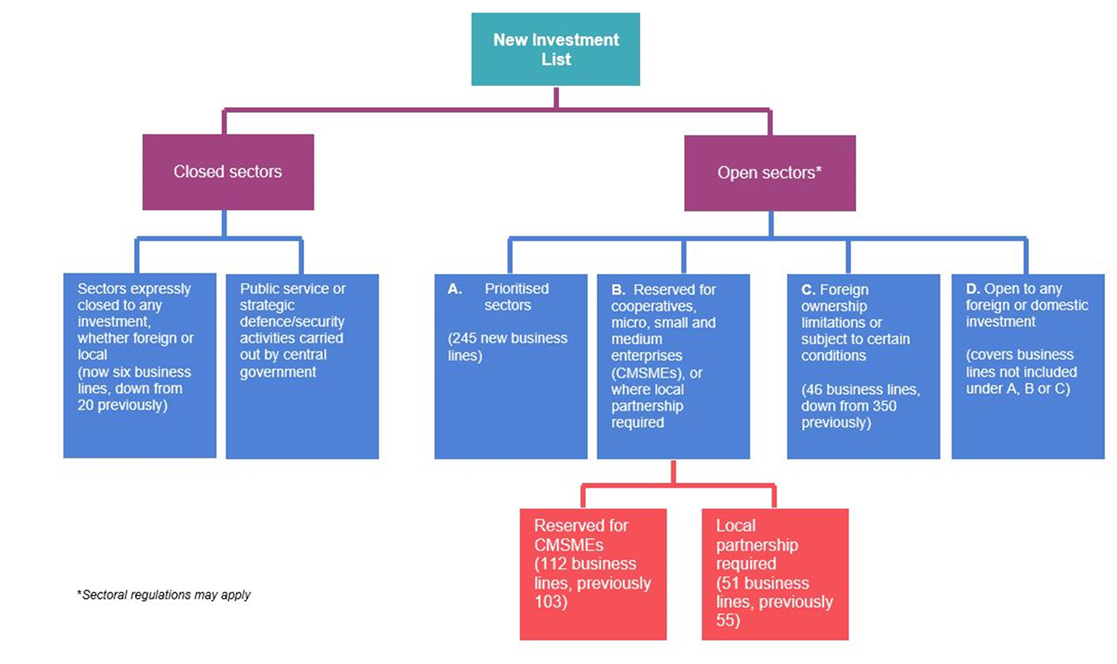

The overall architecture of the New Investment List is set out below.

To properly understand the New Investment List and particularly the specific sectors that are open to foreign investment or subject to certain restrictions, it must be read in conjunction with the Investment Law (as amended by the Omnibus Law), the 2020 Indonesian Standard Business Classification code (Klasifikasi Baku Lapangan Usaha Indonesia or KBLI) and, where relevant, specific sector laws and regulations.

Relaxation of foreign investment restrictions

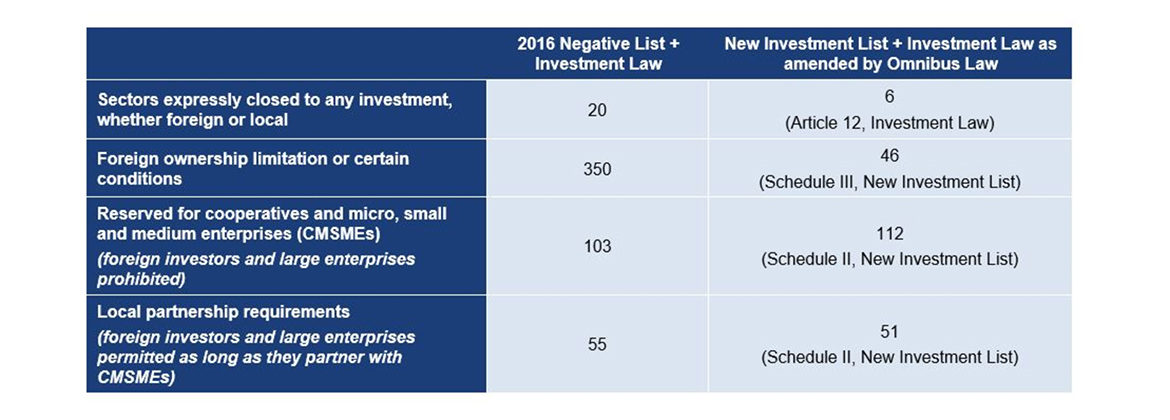

The New Investment List on its face significantly reduced the number of sectors that are wholly closed to any form of investment (foreign or local) and those that are either totally closed or partially open to foreign equity investment.

This is in line with Indonesian government efforts to encourage more foreign direct investment in Indonesia to create jobs and counteract the impact of the Covid-19 pandemic. These changes are summarised in the table below.

Certain important sectors are now open for foreign investment

Wholesale distribution was previously subject to a 67% foreign ownership limit and is not mentioned at all in the New Investment List, and hence should be wholly open for foreign investment. We are in the process of confirming this with the regulators.

Telecommunications, media, and technology (TMT) is another sector liberalised under the New Investment List. Various telecommunication businesses were previously subject to a 67% foreign investment limit but are no longer mentioned in the New Investment List – businesses that include cellular operators and internet service providers.

Some of the changes are quite subtle however, and policy issues may still come into play in any specific application of the new rules. As a result, the changes may not be clear cut for some sectors, with further analysis required to determine the actual foreign ownership restrictions for that sector under the new legislation.

It is also unclear how quickly some of these changes will be embedded in Indonesia’s online OSS business registration system, so some patience may be required.

Key features of the New Investment List

New or modified features

In broad terms, the overall architecture of the New Investment List is not a radical departure from the previous investment regime, but there are a number of new or modified features, including:

Prioritised sectors. As can be seen in the diagram above, the New Investment List has reclassified business sectors that are open to investment into four broad categories and introduced a new concept of “prioritised sectors”. Prioritised sectors satisfy certain criteria – projects that are of national strategic significance, that are capital intensive or labour intensive, that require sophisticated technology, or that are pioneering industries, export-oriented and/or oriented towards research, development and innovation.

A total of 245 “prioritised sectors” are listed in Schedule I of the New Investment List. Subject to satisfying certain conditions, capital investments in these sectors are eligible for:

- Fiscal incentives, consisting of:

- tax incentives, including (i) income tax for investment in certain sectors and/or locations (tax allowances), (ii) in corporate income tax reductions (tax holidays) or (iii) corporate income tax reductions and net income reduction facilities for capital investment as well as gross income reductions for certain activities; and

- customs incentives, in the form of import duty exemptions on imports of machinery, goods and materials for construction or industrial development.

- Non-fiscal incentives, through simplified business licensing, provision of supporting infrastructure, guaranteed energy supply or raw materials, immigration, workforce and other facilities in accordance with applicable laws and regulations.

Special Economic Zones. Foreign investments in technology start-up sectors (“Bidang Usaha rintisan berbasis teknologi”) in Special Economic Zones are exempt from the minimum investment threshold of IDR10 billion (excluding land and buildings).

Investment treaties. The foreign ownership restrictions set out in the New Investment List will not apply to foreign investors holding special rights under investment treaties between Indonesia and their home countries – except where the New Investment List is more favourable to them.

Retention or clarification of existing features

Certain features of Indonesia’s previous investment regime have been retained and/or clarified, including:

Minimum investment requirement. Foreign investors may still only engage in businesses with a minimum investment exceeding IDR10 billion (excluding land and buildings) unless specifically exempted.

The "grandfathering" principle retained. Consistent with Indonesia’s long-term practice of protecting previous investments from subsequent tighter restrictions, any new and more onerous foreign ownership limitations introduced under the New Investment List will not apply to investments approved before the promulgation date of the New Investment List (ie, before 2 February 2021). However, existing foreign investors can take advantage of foreign ownership limitations under the New Investment List that are more favourable.

Business sectors/activities reserved for cooperatives, micro, small and medium enterprises (CMSMEs). Foreign investors and domestic large-scale enterprises are prohibited from engaging in sectors and business activities reserved for CMSMEs. These are set out in Schedule II of the New Investment Law and fall under the following three criteria:

- business activities that do not use technology or use only simple technology

- business activities that have special processes, are labour-intensive, and have special cultural heritage passed on for generations; and/or

- the capital required for the business does not exceed IDR10 billion (excluding land and buildings).

Business sectors/activities open to foreign investment or large-scale enterprises under a partnership arrangement with CMSMEs. These business sectors and activities are set out in Schedule II of the New Investment List and are, to a large extent, carried out by CMSMEs, which are encouraged to participate in a large-scale business supply chain. In practice, the required partnership arrangement may be in the form of profit sharing, operational cooperation (kerja sama operasional), outsourcing, distribution or subcontracting.

Special Economic Zones. Investments in Special Economic Zones are not subject to foreign ownership limitations and special conditions that otherwise apply to a particular business sector. As of February 2021, there were 11 Special Economic Zones already in operation in Indonesia, and four in development. Visit https://kek.go.id/peta-sebaran-kek for more details on the locations and designation of these Special Economic Zones.

Partnership with CMSMEs. Requirements that certain sectors are reserved for or require partnership with CMSMEs, and the applicable foreign ownership limitations and conditions for specific sectors, are exempted if the foreign investment is carried out indirectly or by way of portfolio investment through the Indonesian Stock Exchange. This is the longstanding “portfolio” exemption under the Investment Law, which is typically interpreted in practice to allow investing in non-controlling stakes in publicly listed companies in Indonesia, even if the business is otherwise subject to foreign ownership limits.

Sector-specific regulations (and potentially policies) continue to apply

The Investment Law (as amended by the Omnibus Law) and the New Investment List expressly provide that all business lines not included in the law or the list are open for any investment.

The New Investment List also states that business licensing and the implementation of investment should be carried out in accordance with the “norms”, standards, procedures and criteria of a particular business sector, in accordance with the relevant and applicable laws.

This suggests that sector-specific regulations and the policies of technical government ministries and sector-specific regulators will continue to apply under the New Investment List regime.

The New Investment List also states specifically that matters relating to licensing and implementation of investment in the financial and banking sectors will be carried out in accordance with the requirements of the relevant sector-specific laws.

However, Article 13 of the New Investment List states that once the list takes effect, all requirements under laws and regulations relating to specific sectors will continue to be effective so long as those laws and regulations do not contradict the provisions and requirements under the New Investment List.

So, when considering the implications of the New Investment List and the Investment Law (as amended by the Omnibus Law), careful analysis of existing sector-specific laws and regulations will be needed to determine whether they still apply, and how they may affect the foreign ownership restriction analysis.

For example, the mining business is not included in the New Investment List as a business line that is subject to foreign ownership restrictions. However, certain mining sector regulations – particularly Law No. 4 of 2009 (as amended) and Government Regulation No. 23 of 2020, which require gradual divestment to a local shareholder – will continue to apply.

As another example, telecommunication towers providers are no longer included in the New Investment List, but a joint ministerial regulation issued in 2009 for a tower provider to be a wholly owned domestic company (perusahaan nasional) has not yet been expressly revoked. We have engaged in consultations with the regulator, who has confirmed that the 2009 regulation will be superseded by the more liberal New Investment List, and our view is that this is the correct position.

It also remains to be seen whether unwritten policies of technical ministries will continue to be recognised in practice. One example is the distribution of pharmaceutical drugs, which was a closed sector under the 2016 Negative List based on an unwritten policy of the Ministry of Health and Indonesian Food and Drug Supervisory Agency (BPOM).

While this is an area to watch, it is hoped that Indonesia’s various technical ministries and authorities will fall in line with the broader liberalisation policies of the Government, designed to encourage greater economic openness and globalisation.

This is the first in a new series of bulletins on the impact of the Omnibus Law’s implementing regulations on investment in Indonesia. Upcoming bulletins will take a sector-specific approach, covering TMT, energy and infrastructure, distribution and logistics, among others.

(Article first published 25 February 2021, updated 5 March 2021)

Legal Notice

The contents of this publication are for reference purposes only and may not be current as at the date of accessing this publication. They do not constitute legal advice and should not be relied upon as such. Specific legal advice about your specific circumstances should always be sought separately before taking any action based on this publication.

© Herbert Smith Freehills 2024