The EU Interchange Fees Regulation (Regulation) has been introduced to regulate interchange fees in the EU and came into force on 8 June 2015.1

From December 2015, consumer debit and credit interchange fees are capped on a 'per transaction' basis at 0.2% for debit cards and 0.3% for credit cards. Th Regulation is intended to provide greater transparency on fees, enhance competition for payment card schemes and allow for more innovation in new payment technologies.

What are interchange fees?

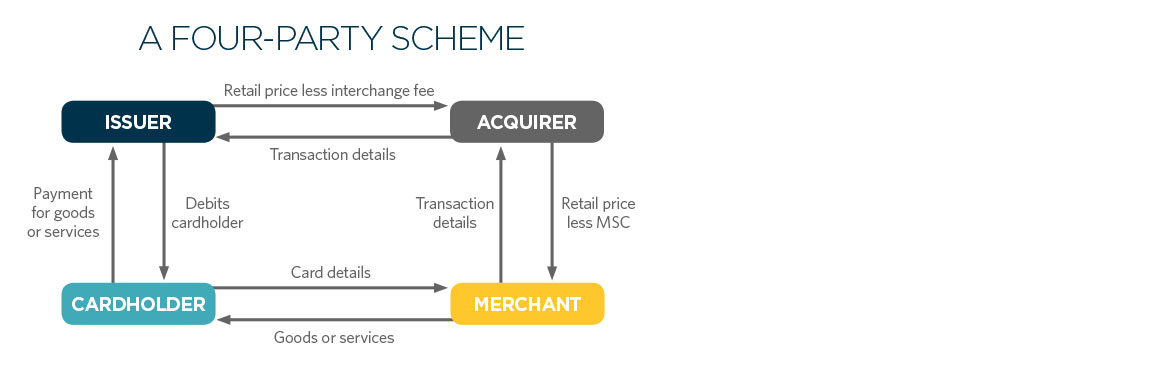

Interchange fees are multilaterally agreed fees applicable to card payment transactions which are agreed through a card payment scheme. The most common type of card payment schemes are 'four party' schemes which involve the cardholder, the merchant, the bank that provided the cardholder with the card (issuing bank) and the bank that provides services to the merchant (acquiring bank). The arrangement takes place within a scheme run by an organisation under a common brand such as MasterCard or VISA. Under these schemes, when a customer pays for a purchase with a debit or credit card, the acquiring bank pays a fee (the interchange fee) to the issuing bank. The acquiring bank then passes on the interchange fee to the merchant through the merchant service charge.

A 'four party' scheme

By contrast in a 'three party' scheme, such as American Express, the same organisation carries out the issuing and acquiring functions. The Regulation also applies to three party schemes although they are exempt from certain provisions (e.g. the interchange fee caps).

Why was the Regulation adopted?

The European Commission (Commission) considers interchange fees have been too high and raise competition concerns as the interchange fee is set out in the scheme rules and applicable across all transactions and participating banks, creating a minimum price floor. These costs are subsequently passed on to consumers in the form of higher prices. The Commission also considers that significant variations in interchange fees between EU Member States and territorial restrictions in licensing agreements and payment card schemes could lead to fragmentation of the EU internal market. The Regulation is intended to make the market for card-based payments more transparent and to facilitate a European internal market for card-based payments and internet and mobile payments based on cards.

What does the Regulation cover?

The Regulation caps interchange fees for 'four party' schemes at 0.2% of each debit card transaction and 0.3% of each credit card transaction for both cross-border and domestic transactions.

However, for domestic debit and credit interchange fees, EU member states (Memeber States) can:

- set lower caps for domestic interchange fees,

- for a five year transitional period, allow a weighted average interchange fee of no more than 0.2% of the annual average transaction value of all domestic debit card transactions within each payment card scheme (rather than a 'per transaction' cap), and

- allow a 'per transaction' interchange fee of no more than EUR 0.05 (or the equivalent in a non-euro currency) which is intended to promote the use of card-based payments for small amounts.

The Regulation also contains anti-circumvention provisions,2 which state that the interchange fee calculation must also include any 'net compensation' with an 'object or effect' of the interchange fee which is intended to capture payments such as marketing incentives, bonuses and rebates for meeting certain transaction volumes.

The interchange fee caps do not apply to:

- commercial cards (cards issued and used for business expenses),

- ATM cash withdrawals, or

- three party schemes, unless a payment service provider is used for transactions, or cards are issued with a co-branding partner.3

Additional provisions

The Regulation also has provisions which:

- Prohibit any territorial restrictions or any restrictions that hinder or prevent co-badging (including two or more payment brands or applications in the same payment instrument) in licensing agreements and payment card scheme rules.

- Relate to the separation of payment card schemes and processing entities.

- Ensure both merchants and customers are aware of the fees applicable to payment card transactions.

- Abolish rules which prevent merchants from steering customers towards the use of a specific payment instrument. However, these prohibitions on steering must be read in conjunction with the provisions of the Payment Services Directive.4

- Effectively alter the 'honour all cards' rule so that merchants accepting one issuer's cards within a scheme are only obliged to accept other cards issued within the same scheme, where they are subject to the interchange fee caps.

When does the Regulation come into force?

The Regulation came into force on 8 June 2015 but certain provisions only come into force at a later date:

- 9 December 2015: interchange fee caps, prohibitions on territorial restrictions in licensing agreements and the provisions regarding information to customers, and

- 9 June 2016: provisions regarding separation of payment card schemes and processing entities, co-badging, information to merchants and the 'honour all cards' provisions.

In addition, Member States are also required to designate competent authorities to enforce the Regulation and must also lay down rules on penalties regarding infringements of the Regulation, by 9 June 2016. In the UK, the designated body is the Payment Services Regulator (PSR).5 The PSR has not yet issued any guidance in respect of how it intends to enforce the Regulation.

Endnotes

- Regulation 2015/751 on interchange fees for card-based payment transactions.

- Article 5 of the Regulation.

- These types of three party schemes are exempted from the caps for a transitional period, provided that their share of transactions do not exceed 3% of all card-based transactions in the Member State (see Article 1(5) of the Regulation).

- Directive 2007/64/EC. The Payment Services Directive has been revised and is currently going through the EU legislative process. The formal adoption of the revised directive is expected later this year.

- Payment systems regulator.

Key contacts

Kyriakos Fountoukakos

Managing Partner, Competition Regulation and Trade, Brussels

Legal Notice

The contents of this publication are for reference purposes only and may not be current as at the date of accessing this publication. They do not constitute legal advice and should not be relied upon as such. Specific legal advice about your specific circumstances should always be sought separately before taking any action based on this publication.

© Herbert Smith Freehills 2024