In our recent trust company risk and compliance survey we asked trust companies what are the greatest risk and compliance challenges they face. The respondents identified beneficiary disputes, (i.e. disputes between the trustee and one or more of the beneficiaries) as one of the significant challenges trustees face. They nevertheless ranked it as the least pressing issue, when compared to other matters such as AML and regulatory compliance, tax, cyber, and data protection issues. We also asked the question of what trust companies see as the most common sources of beneficiary disputes.

The results are in

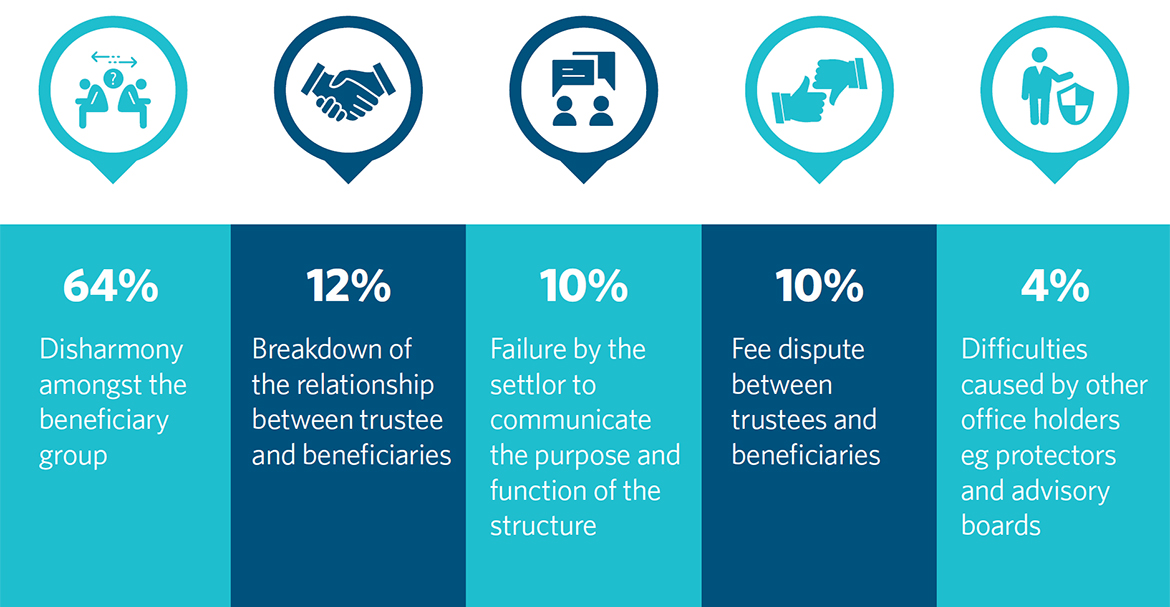

A small minority of respondents (approximately 4%) considered the primary source of beneficiary disputes to be the difficulties caused by other office holders (e.g. protectors and advisory boards). Around 10% of the respondents considered the failure by the settlor to communicate the purpose and function of the structure to be the main issue, while a similar proportion of respondents identified fee disputes between trustees and beneficiaries as the main source of beneficiary disputes. A slightly larger proportion of respondents (12%) concluded that the breakdown of the relationship between trustee and beneficiaries was the primary source of beneficiary disputes.

WHAT IS THE PRIMARY SOURCE OF BENEFICIARY DISPUTES?

By far the most significant proportion of trust companies surveyed thought that the principal source of beneficiary disputes was disharmony amongst the beneficiary group (64%). However, the numbers can look quite different when we look at trust companies of different sizes and ownership structures.

While the responses from medium sized trust companies reflected the responses of the whole respondent pool (65%), only 34% of smaller trust companies identified disharmony amongst beneficiaries as the most common source of beneficiary disputes. The numbers seem to be skewed in the other direction in large trust companies, where 91% gave the same answer, which suggests that large, international trust companies are more often faced with disharmony amongst the beneficiary group.

When we focus on ownership structure, the data also reveals some discrepancies in the prevalence of disharmony amongst the beneficiary group within different types of trust companies. Bank owned and independent trust companies’ responses by and large reflect the whole respondent pool’s views (with 69% and 55% respectively identifying disharmony amongst beneficiaries as the primary source of beneficiary disputes). This is in contrast to responses from private equity backed (83%) and professional services owned (80%) trust companies.

There are of course any number of explanations for these results (and it would be impossible to draw too many general conclusions). For example, professional services owned trust companies may have a greater appetite for risk and be prepared to take on structures which have greater potential for disharmony.

In light of these results, we will focus on what trustees and trust companies might be able to do proactively to seek to resolve disputes arising out of a conflict amongst the beneficiaries and prevent these from escalating to a dispute between the trustee and beneficiaries. In this article we will focus on situations where the breakdown of the relationship within the beneficiary group has already happened. There are many excellent resources on the steps trustees might be able to take to avoid such relationship breakdowns in the first place. The focus here is what trustees might be able to do to avoid the existing dispute within the beneficiary group turning into proceedings against the trustee.

Why would beneficiaries bring proceedings against trustees?

Actions brought by beneficiaries against trustees often manifest themselves as claims for either breach of trust or breach of fiduciary duties. Sometimes such claims arise out of a genuine dissatisfaction on the beneficiaries’ part about the performance of the trustee’s duties or management of the trust. However, in other instances, beneficiary disputes can be a result of beneficiary group disharmony (for example within different factions of a family). In this situation the trustee can get caught in the middle of internal family struggles regarding how the trust should be administered, and might be sued by a dissatisfied faction as a result. This may be because there is no actionable legal claim against the other family members or because it is more palatable to sue a third party trustee rather than family.

If there were ever a map-based metaphor for these kind of family battles – people being close in one sense but also very far apart – the Diomede Islands in the Bering Strait are it. Big Diomede is Russian, Little Diomede is American. They are only four kilometres apart, but fall on different sides of the international dateline so are a day apart.

Disharmony amongst the beneficiary group, and what to do about it?

To intervene or not to intervene?

One of the first issues trustees will have to consider when dealing with disharmony within the beneficiary group is whether it might be helpful for the trustee to try to "mediate" the conflict between the beneficiaries and try to settle some of the disagreements. This may avoid the dispute escalating into one between the trustee and the beneficiaries, or certain beneficiary groups.

On the one hand there is an obvious danger in the trustee getting involved in the squabbles of beneficiaries, as this could lead to allegations of meddling, partiality or breach of fiduciary duties by a disgruntled beneficiary/beneficiary group. If not resolved, this can lead to a relationship breakdown between the trustee and beneficiaries/beneficiary group, and expensive litigation as a result of the trustee having placed itself “in the line of fire”.

On the other hand, if the trustee does not make any attempt to resolve the dispute between beneficiaries, the trust could become increasingly difficult to administer as a result of ongoing animosity. Further, if the dispute remains unresolved, the trustee may in any event end up being sued by a disgruntled beneficiary/beneficiary group.

There are a number of factors trustees have to weigh up when making the decision about whether (and if so, how far) to intervene in a dispute amongst beneficiaries. Some of the reasons why some trustees might be reticent to get too involved include the following:

- Impartiality – The more involved a trustee gets in disputes between beneficiaries, the more difficult it might become for the trustee to remain impartial. And of course, the more the trustee knows about the internal workings and politics of the beneficiary group, the more decisions to act in the best interest of the beneficiaries become nuanced and complex.

- Increased liability – Trust instruments often include anti-Bartlett clauses which operate to exclude the trustee’s duty to enquire and supervise in relation to actions taken by a company in which the trust has a shareholding. However, such clauses may well not prevent liability arising if the trustee does in fact become aware of something indicating that they should use their powers of intervention. The danger here is therefore that if a trustee inserts itself/herself/himself into an existing dispute between the beneficiaries, he or she might become aware of matters necessitating enquiry or supervision, which can negate the effect of the anti-Bartlett clause, and increase the trustee’s risk exposure.

- Traditional forms of relief may be unavailable – One form of relief trustees are normally entitled to seek is to make a Beddoe application. This involves seeking court directions in relation to whether or not to bring, defend or continue proceedings by or against the trust, and obtain costs protection. In a beneficiary dispute situation, however, trustees are often not entitled to Beddoe protection like they would be in relation to third party disputes because the allegations made often involve breach of trust. Thus the court would need to resolve the underlying dispute between the trustee and the beneficiaries before deciding whether or not it should approve the trustee’s involvement in the litigation in question. The appropriate course in such cases is to resolve the underlying dispute, rather than pursue a Beddoe application.

- Insurance – Increased trustee involvement could increase the likelihood of the trust company needing to claim on its insurance policy in the event of a beneficiary dispute. In this respect it will become increasingly important for the trust company to maintain clear channels of communication and a good working relationship with its insurers.

What can trustees do in practice?

We asked some of our colleagues at trust companies about how they might deal with disharmony amongst beneficiaries in practice. Notwithstanding the considerations set out above, it was clear that those we spoke to prefer to get involved and take active steps to attempt to resolve conflicts within the beneficiary group, in order to seek to avoid further escalation. Sitting back in the hope that the beneficiary group will resolve the conflict amongst themselves was no one’s preferred option.

The universal theme was that getting involved early, and communicating with the beneficiary group about the options to resolve their internal disputes in a frank and honest manner, can go a long way in preventing the escalation of disharmony within the beneficiary group. Grant Barbour of Ocorian explained “it is crucial to engage positively and immediately with the beneficiary group; trustees should get involved quickly and explain how corrosive disputes between beneficiaries can be, and there is no faster way to destroy a trust fund, than engaging in costly litigation.”

In their communications with beneficiaries, trustees should remain impartial and emphasise their impartiality, as necessary. It may also be advisable to remind the beneficiaries that the trustee’s obligation is to act in the best interest of the beneficiaries at all times, in order to keep these ideas at the forefront of the beneficiaries’ minds.

In addition, trustees should consider practical, creative solutions to resolve disputes within the beneficiary group. In this regard, trustees could take guidance from the approach of Clare Usher-Wilson of Summit, who said of her interventionist approach: “As trustees, we get very involved in beneficiary disputes, and we think there is a solution to every dispute, but these often require thinking creatively and outside the box”. Some of the tactics we have seen used in practice are as follows:

- Resignation from board – In a situation where some beneficiaries are represented on a private trust company’s board, while others are not, consider whether it is worth encouraging the represented beneficiaries to resign to allow trustees to carry out their management role without the suggestion that the represented beneficiary faction has larger influence (perceived or real) than those not represented.

- Representation – Where there is a breakdown in the relationship within a family council of beneficiaries with a particular individual, the trustees may wish to consider appointing a neutral third party to represent that individual on the family council to restore the functionality of that forum, and re-open effective communication channels with the entirety of the beneficiary group.

- Respecting the natural order of the family – To avoid aggravating the beneficiary group, trustees should try to respect existing family dynamics wherever possible. So for example if parents have particular wishes or restrictions on how, if at all, the trustees should be allowed to communicate with their beneficiary children, the trustees should be sensitive to those requests, even if the parents themselves may not be beneficiaries. In practice this may manifest as an agreement (whether a formal memorandum of understanding, or a more informal option) with the parents on the method, frequency etc. of communication with the beneficiary children.

- Splitting the trust fund – If it seems that certain members of the beneficiary group will never be able to see eye to eye and agree on matters, it might be worth considering splitting the trust fund to divide up the pot, and give the different groups more influence over decisions.

- Mediation – Trustees are also able to recommend mediation to resolve a dispute within the beneficiary group. As with any formal dispute resolution mechanism, the advantage is that if a middle ground is found, the beneficiaries are likely to respect a more formal resolution arrangement. However, given the formality of the procedure, a mediation might encourage different factions to lawyer up and crystallise or entrench their position more than a less formal dispute resolution mechanism might. Further, even though mediation is almost always cheaper than litigation, it is not without cost, which will likely be paid from the trust fund.

- External advisors – In order to avoid personally getting entangled in the underlying beneficiary dispute, trustees might wish to consider engaging external consultants who might be able to negotiate a de-escalation amongst the family members. This may be a way of reducing the trustee’s exposure in a conflict situation, but the benefits of that need to be weighed against the fact that appointing an external consultant to resolve a dispute will reduce the trustee’s ability to control the situation.

Given the above, it goes without saying that good communication is crucial for trustees, and may also become an area in which trust companies wish to invest resources to upskill trust professionals’ communication and mediation skills to be able to effectively deal with conflicts and disharmony amongst beneficiaries, without feeding existing fires.

To review the other articles in this series, please click on the link below.

Key contacts

Legal Notice

The contents of this publication are for reference purposes only and may not be current as at the date of accessing this publication. They do not constitute legal advice and should not be relied upon as such. Specific legal advice about your specific circumstances should always be sought separately before taking any action based on this publication.

© Herbert Smith Freehills 2024