The global automotive industry is facing unprecedented challenges as it responds to the drive to decarbonise the transport sector to meet national and international emission reduction targets whilst navigating the impacts of the Covid-19 pandemic and the acute worldwide shortage of semi-conductors.

With these challenges, however, come new business opportunities: for example the development of new technologies facilitating industry-wide initiatives for connected and autonomous vehicles, ever more capable and efficient electric vehicles and mobility as a service platforms.

Our automotive hub brings together our very latest industry thinking, from the launch of our new campaign EV Batteries: Powering the automotive revolution, which considers the opportunities and challenges across the whole EV battery lifecycle, through to our current thinking on COP26 related climate change considerations for the sector. In addition, our ongoing 'views on an evolving automotive industry' insights series explores a number of key topics including intellectual property issues and available government support and incentives.

EV batteries: Powering the automotive revolution

The global market for EV batteries is growing at a breath-taking pace as the automotive industry rapidly electrifies to meet accelerating decarbonisation and emissions targets. Within this, European production capacity is currently tiny (3% of global lithium-ion battery supply versus a 19% share of global demand) and, whilst not all of the batteries need to be manufactured in Europe/the UK, a combination of the geo-political, economic and sustainability driven-desires to near-shore this industry means that it is anticipated that the European EV battery market will grow by over 20% per annum until 2030, requiring very significant levels of capital investment.

This rapid expansion of a nascent industry requires the stitching together of a number of manufacturing and industrials sector and projects skill-sets: land acquisition and use permits; planning consents and construction; debt, equity and project finance; national and regional government grants and subsidies; R&D and licensing of key intellectual property rights; recruiting, training and retaining a skilled workforce; and building a resilient, efficient and competitive supply chain and distribution channels, and that is before you even start to think about the vital, second-life reuse and recycling phase.

The sheer scale and speed of the above task would, on its own, be a sufficient challenge for most businesses, but it is far from the full picture and, in many respects, is the easier part of the challenge because it is, to a degree, more predictable.

The other part of the picture is more uncertain: per unit costs of batteries will have to reduce materially in order to enable BEVs (particularly smaller BEVs) to penetrate the mass market, but the automotive industry is at the same time demanding that the batteries have a higher energy density (delivering both increased range and longevity), are capable of being recharged faster (requiring higher power density) and yet are safer (particularly as regards the risk of fire), lighter and smaller (or at least more flexible in how they can be integrated within the vehicle).

Critically, this all needs to be implemented within the same decarbonisation programme which is driving the transition to EVs in the first place and therefore the increased demand for (often scarce) natural resources and the broader ESG footprint of the batteries themselves is also coming into ever-sharper focus.

The infographic looks at the stages of the battery lifecycle and some of the specific industry drivers and issues that will shape the direction of the industry (particularly in Europe), including the presence of EU and governmental incentives and other funding and support; the increasing ESG and regulatory pressures, principally through the proposed new EU Batteries Directive; as well as other laws that will continue to be important in defining the playing field for the industry, such as product liability and safety, competition, trade and State Aid, employment and intellectual property.

Recent insights

Cross Examining Cyber: Conversations on Cyber Law

Automotive – M&A active as industry looks ahead

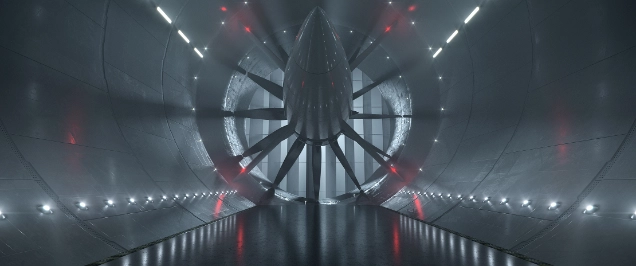

Energy transition – Can hydrogen turn sci-fi into fact?

EU Batteries Regulation: A phased approach to new sustainability and transparency targets

Financing the Energy Transition – The Gigafactory Build-out

Financing the Energy Transition - Critical Minerals Processing

The UK and EU automotive aftermarket sector – New regulations afoot

OECD Revises Guidelines for Multinational Enterprises on Responsible Business Conduct

How last mile delivery can accelerate the automotive industry's drive to net zero

Global M&A Outlook 2023: Automotive Electric and digital revolutions still drive M&A

Adapting road safety to autonomous vehicles, joint law commission issues report on legislative changes

EV batteries: Powering the automotive revolution

Key contacts

Dr Sönke Becker

Partner, Head of Corporate Germany, Co-Head Manufacturing & Industrials, Germany