ASIC’s new ‘fees for service’ model will commence on 1 July 2018. This model is part of ASIC’s industry funding model: a user-pays system. The new model will result in significantly increased fees for takeovers and schemes.

IN BRIEF

- ASIC is introducing a new 'fees for service' model from 1 July 2018 as part of its industry funding model.

- The 'fees for service' model is intended to ensure that ASIC’s costs are borne by those creating the need for regulation and to ensure that ASIC is adequately resourced.

- The new model will result in significantly increased fees for takeovers and schemes. However, the new fees will remain, by international standards and in the context of overall deal costs, very low.

BACKGROUND

The industry funding model

An industry funding model for ASIC was announced by the Government on 20 April 2016, following recommendations by the Financial System Inquiry that industry should fund the costs of ASIC’s regulatory activities. Currently, only a small portion of ASIC’s costs are recovered from industry, with the difference being subsidised by taxpayers.

The new model applies to the full range of regulatory activities undertaken by ASIC, including (but by no means limited to) supervision of:

- takeover bids under Chapter 6 of the Corporations Act;

- schemes of arrangement under Part 5.1 of the Corporations Act; and

- member approved acquisitions (including trust schemes) under item 7 of s611 of the Corporations Act.

The 'fees for service' model will commence on 1 July 2018. This is subject to consultation and the passage of the legislation.

Purpose of the model

The industry funding model for ASIC is intended to:

- ensure that the costs of regulatory activities undertaken by ASIC are borne by those creating the need for regulation, rather than the Australian taxpayer;

- establish price signals in the way resources are allocated within ASIC;

- provide economic incentives to drive the Government’s desired regulatory outcomes for the financial system; and

- improve ASIC’s cost transparency and accountability to industry.

ASIC has stated that the introduction of the 'fees for service' arrangements will ensure that, from 1 July 2018, ASIC will fully recover its costs for specific regulatory activities requested by an entity.

IMPACT ON M&A RELATED SERVICES

As mentioned above, the 'fees for service' model includes ASIC’s compliance reviews of disclosure documents in control transactions, including in takeovers, schemes of arrangement and trust schemes.

The following table compares the current fee with the proposed new fee.

| Current fee | Proposed fee | |

|---|---|---|

| Bidder’s statement – off-market bid | $2,400 | $5,264 |

| Bidder’s statement – on-market bid | $1,194 | $5,130 |

| Target’s statement – off-market bid | Nil | $2,565 |

| Target’s statement – on-market bid | Nil | $2,565 |

| Scheme booklet – scheme of arrangement | $800 (plus a $39 fee on registration) | $5,290 (plus a $321 fee on registration) |

| Explanatory statement - member approved acquisitions (including trust schemes) under item 7 of s611 | Nil | $2,565 |

COMMENTARY

Whilst there will inevitably be some who bemoan the increase in ASIC’s fees (including the fact that some regulatory activities that were previously not charged for will now attract a fee, such as the review of a target’s statement), the undeniable fact is that ASIC’s proposed increased fees will remain, by international standards and also by reference to overall deal costs, very low.

By way of comparison:

- in the United Kingdom, charges are payable to the Panel on Takeovers and Mergers on an offer on a scaled basis according to the value of the offer, for example a charge of £2,000 applies to an offer valued between ₤1-5m, resulting in a fee of up to 0.20% of the offer value. For an offer valued between ₤100-250m, a fee of £75,000 applies, resulting in a fee of up to 0.075% of the offer value.1 Additional fees payable to the UK Listing Authority of between £15,000-£50,000 apply if a prospectus is required, and other fees can be imposed if other incidental documents (such as shareholder approval circulars) require review by the relevant authorities; and

- in the United States, the filing fee rate for the U.S. Securities and Exchange Commission is $124.50 per $1,000,000. As such, the filing fee due is calculated by ‘multiplying the aggregate offering amount by 0.001245’.2

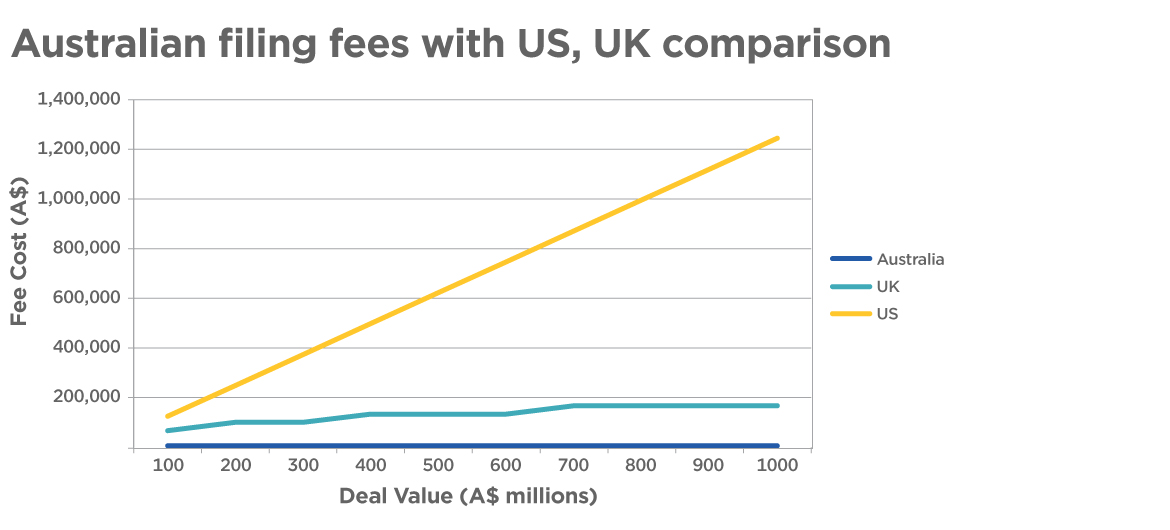

The following graph highlights the difference in filing fees for public M&A transactions between Australia, the US and the UK.

Assumptions applicable to UK filing fees in the above graph: The transaction involves an all cash offer, and is neither a hostile takeover nor a reverse takeover.

For illustrative purposes, in terms of overall deal costs:

- the transaction fees on the 2018 Westfield / Unibail-Rodamco transaction were, at the time the scheme booklet was published, estimated to be EUR 346 million (c.A$538 million); and

- the transaction fees on the 2017/18 Tatts / Tabcorp transaction were, at the time the scheme booklet was published, estimated to be A$200 million.

Whilst ASIC’s objective in the ‘fees for service’ model has been all about ‘cost recovery’ (which is a laudable objective), one might query whether ASIC and the Government have missed an opportunity in the M&A regulatory space. We suspect that there would be few market participants in the takeover space who would complain about paying materially higher fees than those currently proposed if it allowed ASIC to recruit additional staff (such as experienced public M&A lawyers and investment bankers).

Endnotes

- The Takeover Panel, Fees and Charges.

- U.S. Securities and Exchange Commission, Filing Fee Rate. Filing fees are required pursuant to the Securities Exchange Act of 1934, § 13(e), 14(g) (1934); Securities Act of 1933, § 6(b).

Legal Notice

The contents of this publication are for reference purposes only and may not be current as at the date of accessing this publication. They do not constitute legal advice and should not be relied upon as such. Specific legal advice about your specific circumstances should always be sought separately before taking any action based on this publication.

© Herbert Smith Freehills 2024