Summary

- Australian Securities and Investments Commission (ASIC) has issued a report outlining its recent regulatory activities and concerns, and developments, in relation to takeovers, schemes and item 7 approvals.

- There has been a substantial increase in companies voluntarily providing draft item 7 explanatory memorandums to ASIC.

- There have been a number of deals which technically fall within the exceptions to the 20% rule, but which breach the policy objectives of Chapter 6.

- A number of deals have involved substantial shareholders being given veto rights over matters which would normally be reserved for the board.

- ASIC has taken court action for breaches of Chapter 6 where it has considered it appropriate to do so.

- ASIC has had concerns with the quality of a number of independent expert’s reports, particularly those prepared for lower price points.

Overview

ASIC has recently released a report (Report 423: ASIC regulation of corporate finance: July to December 2014) which sets out its recent regulatory activities and developments, and the concerns it has had, in corporate transactions including takeover bids, schemes of arrangement and shareholder approvals under item 7 of s611 of the Corporations Act 2001 (Cth) (Corporations Act). The report reveals a number of interesting developments. Some of those developments are outlined below.

Item 7 shareholder approvals

Shareholders are able to approve increases in voting power above the 20% threshold under item 7 of s611 of the Corporations Act. There is no requirement to provide a draft copy of a relevant explanatory memorandum to ASIC for its review before its despatch to shareholders; although ASIC does encourage companies to do this voluntarily. In its report, ASIC has observed a 'substantial increase' in companies doing this voluntarily.

Misuse of takeover exceptions

ASIC has noted that it is encountering a number of 'novel transaction structures' which technically fall within the exceptions to the 20% rule, but give rise to concerns as to whether they meet the underlying policy objectives of Chapter 6 of the Corporations Act. In this regard, ASIC indicates in the report that it will continue to closely monitor:

- scrip takeovers resulting in reverse takeovers,

- downstream acquisitions, and

- rights offers and underwriting arrangements where there are control issues.

Independent experts

ASIC has again raised concerns with the quality of independent experts’ reports, in particular, regarding the quality of reports and the experience of experts. ASIC has noted that its concerns have most commonly arisen in reports prepared at lower price points and that its concerns have resulted in transaction delays and additional costs associated with engaging new experts.

Shareholder rights in matters generally reserved for boards

ASIC says it has observed a new feature in some control transactions involving substantial shareholders being given veto rights over matters which would normally be within the domain of the board (for example, veto rights over significant strategic and operational decisions). ASIC has expressed concerns that such rights can, among other things:

- inappropriately give effective control over such matters to one particular shareholder,

- serve as a device to deter or hinder control proposals in relation to the company, and

- give the relevant shareholder a level of ongoing control which is disproportionate to its equity holding.

ASIC says it will closely scrutinise deals where veto rights are included in an agreement between a company and a substantial shareholder in a way that is contrary to the policy objectives of Chapter 6. ASIC has also flagged that obtaining shareholder approval for such rights may not necessarily allay its concerns.

Enforcement action

ASIC has reminded market participants that it is prepared to refer matters to its enforcement team when it considers further action is necessary. ASIC cited the following three examples:

- Mariner Corporation Limited – where ASIC has commenced Court proceedings against Mariner and its current and former directors in relation to its bid for Austock Limited. ASIC is alleging that the bid was reckless as Mariner did not have the necessary bid funding in place, the bid breached the minimum bid price rule and the directors breached their duties by failing to give sufficient consideration to the steps that needed to be taken before making the bid,

- Aurora Funds Management Limited – ASIC accepted an enforceable undertaking from Aurora, the responsible entity of a number of listed managed investment schemes, following a surveillance exercise which revealed that Aurora had acquired units on market in four of its schemes which did not comply with the substantial holding disclosure obligations and in one instance breached the 20% rule, and

- Avestra Asset Management – the Commonwealth Director of Public Prosecutions brought proceedings and was successful against Avestra for breaches of the substantial holding disclosure obligations and breaches of the 20% rule. As far as we are aware, this is the first time that someone has been prosecuted and found guilty of a criminal offence as a result of a breach of the 20% rule. The Court imposed a fine on Avestra.

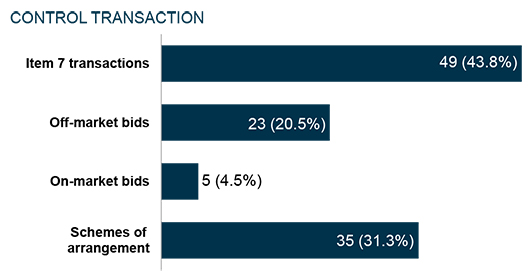

Control transaction statistics

ASIC provided some interesting historical statistics on the use of takeovers and schemes over the period from the 2006 financial year to 31 December 2014. Those statistics are graphically demonstrated below.

Source: ASIC Report 423: ASIC regulation of corporate finance: July to December 2014, p40.

Note: in relation to the 2014-15 scheme booklets, ASIC’s figures show 66 scheme booklets were lodged during this period. However, ASIC said this figure was distorted by 4 restructure schemes with multiple entities. ASIC indicated that, after removing the effect of the distorting transactions, in the first half of 2014-15 there were 18 scheme booklets lodged with ASIC.

Legal Notice

The contents of this publication are for reference purposes only and may not be current as at the date of accessing this publication. They do not constitute legal advice and should not be relied upon as such. Specific legal advice about your specific circumstances should always be sought separately before taking any action based on this publication.

© Herbert Smith Freehills 2024