Summary

- The Australian Securities and Investments Commission (ASIC) issued its most recent report outlining its regulatory activities and concerns, and developments, in relation to takeovers, schemes and item 7 approvals.

- ASIC raised concerns with consideration structures that allow target shareholders to elect to receive a form of consideration that is subject to a cap.

- A scheme acquirer disposing of interests in target shares during the course of the scheme was considered by ASIC, with ASIC offering some guidance as to what it will investigate in this area.

- ASIC examined the case of a scheme acquirer announcing a dividend to its shareholders, conditional on the outcome of the scheme, and indicated it will investigate any similar instances in the future.

- The currency of information in independent expert’s reports and the independence of the expert both received attention from ASIC.

- The most common type of control transaction notified to ASIC in the first six months of this calendar year was transaction approvals under item 7 of section 611 of the Corporations Act 2001 (Cth) (Corporations Act), numbering more than off-market takeover bids and schemes of arrangement combined.

ASIC recently released its third report on corporate finance regulation (ASIC Report 446), covering the period January to June 2015. The report describes ASIC’s regulatory activities, policy initiatives, approach to novel issues seen in transactions during the period and the types of issues that cause it to intervene in corporate transactions including takeover bids, schemes of arrangement and shareholder approvals under item 7 of section 611 of the Corporations Act. The report reveals a number of interesting developments and statistics, some of which are outlined below.

‘Scale backs’ in schemes of arrangement

ASIC raised issues with consideration structures that allow target shareholders in schemes of arrangement to elect to receive a form of consideration that is subject to a cap. In such scenarios, if target shareholders elect to receive more than the aggregate cap of one element of the consideration (eg, the cap on the amount of the bidder’s scrip is reached), the bidder proportionally scales back the chosen consideration (scrip) and substitutes it with the alternative consideration (eg, cash). The ongoing iiNet scheme of arrangement included such a cash/capped scrip consideration mix from TPG.

ASIC’s main issue is that the scale back can create a level of uncertainty for shareholders choosing the capped consideration.

It has traditionally been the case that target shareholder elections could be lodged at or around the scheme record date (eg, see the Perpetual/Trust Company scheme and the Viterra/ABB Grain scheme). However, it appears that in the iiNet scheme of arrangement, ASIC accepted the scrip consideration cap on the basis that iiNet shareholders were required to make their cash/scrip elections, and iiNet publicly announced the outcome of the scale back, before shareholders voted on the scheme. ASIC’s view was that this ensured shareholders were fully aware of the effect the scrip consideration cap, and the resultant scale back, would have on the consideration they were to receive under the scheme before they voted on the scheme.

As the consideration election date was roughly a week prior to the scheme meeting date and more than a month prior to the record date for determining entitlements to the scheme consideration, any person who became an iiNet shareholder in the intervening month was not able to participate in the scrip element of the consideration mix.

ASIC notes that it will consider each scale back on a case-by-case basis, taking into account the value of the alternative consideration, setting of the cap and any relevant disclosure.

Acquiring and divesting interests during a scheme of arrangement

About a month before the Amcom Telecommunications scheme meeting (and after the first court hearing), Amcom’s (ultimately successful) acquirer Vocus Communications sold its 10% interest in Amcom. This disposal of its interest in the target company was in response to a move to counter the opposition to the scheme by TPG (a 19.9% shareholder) who was going to vote against the scheme.

In this instance, ASIC appeared to be satisfied that the motivation for the disposal of the interest was the emergence, before the scheme meeting, of a competitor taking a significant stake in an apparent move to block the scheme. ASIC says that given the unique circumstances around the divestment, and the nature of the limited exceptions in the Corporations Act to the prohibition on similar disposals during takeover bids, it provided its usual no-objection letter for the scheme.

In considering such dealings, ASIC says it will investigate the purpose for which the acquirer’s interests were first acquired, and any divestment process, to ensure the integrity of the scheme process is maintained. ASIC states that it ‘would be particularly concerned if a scheme acquirer’s interest in the target shares were acquired and disposed of to potentially increase the overall vote in favour of a scheme’.

Conditional dividends and schemes of arrangements

Again in the Vocus/Amcom scheme of arrangement, ASIC considered the implications of Vocus announcing a conditional dividend to its shareholders that was dependent on the Amcom scheme of arrangement becoming effective. In other words, if the scheme was approved, a special dividend would be payable to those Vocus shareholders on the Vocus share register on the effective date of the Amcom scheme and paid on the implementation date of the Amcom scheme.

ASIC’s concern was to be comfortable that, where there were common shareholders in Amcom and Vocus, the conditional dividend did not inappropriately induce those shareholders to vote in favour of the scheme.

ASIC notes that it will carefully consider similar arrangements in the future, based on their particular facts.

Currency of independent expert reports

ASIC reminded independent experts and the target that commissioned them that when either the export or target becomes aware of a significant change affecting the information in the expert report, that party should notify the other and consider what impact it may have on the original report.

Independent experts’ independence

In the 2014/15 financial year, ASIC visited a number of independent expert firms to review workpapers, primarily in relation to the experts’ independence. ASIC notes it will visit more firms in the current financial year.

Control transaction statistics

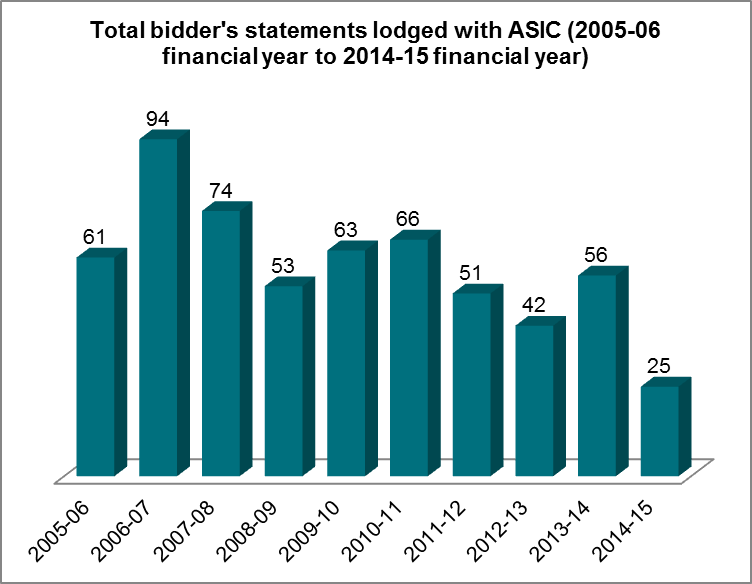

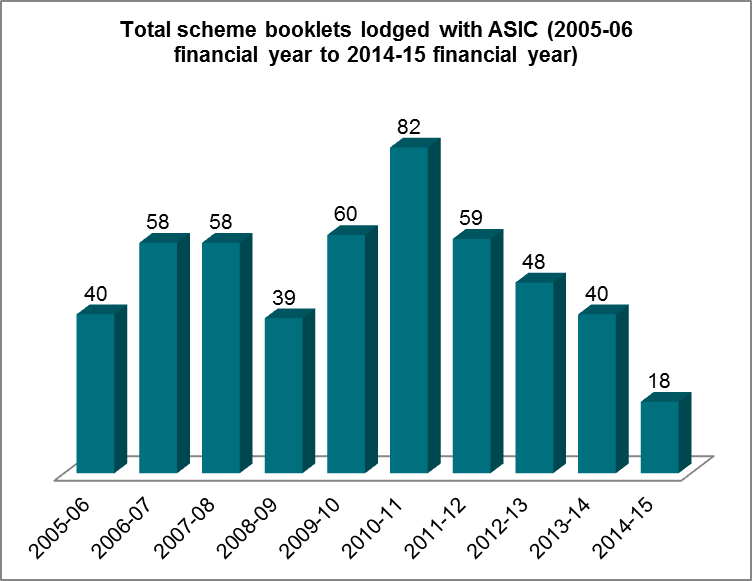

The number of public merger and acquisition transactions, both takeover bids and schemes of arrangement, in the 2014/15 financial year decreased compared to the 2013/14 financial year. ASIC noted that there has been a significant decrease in the use of scrip acquisitions and an increase in transaction size. The most common type of control transaction notified to ASIC in the first six months of this calendar year was transaction approvals under item 7 of s611 of the Corporations Act (35 versus 13 off-market takeover bids and 17 schemes of arrangement).

ASIC provided some interesting historical statistics on the use of takeovers and schemes over the period from the 2001/02 financial year the 2014/15 financial year. Those statistics are graphically demonstrated below.

Source: ASIC Report 446: ASIC regulation of corporate finance: January to June 2015, p41-42. Note: in relation to the 2014-15 scheme booklets, ASIC’s figures show 82 scheme booklets were lodged during this period. However, ASIC said this figure was distorted by 4 restructure schemes with multiple entities. After removing the effect of the distorting transactions, in 2014-15 there were 35 scheme booklets lodged with ASIC.

Legal Notice

The contents of this publication are for reference purposes only and may not be current as at the date of accessing this publication. They do not constitute legal advice and should not be relied upon as such. Specific legal advice about your specific circumstances should always be sought separately before taking any action based on this publication.

© Herbert Smith Freehills 2024