Hydrogen is a hot topic in the global energy sector – and Australia could be a key player in the emerging international market.1

Setting the Agenda: the Australian Hydrogen Landscape

A recent report commissioned by the Australian Renewable Energy Agency (ARENA) examined the hydrogen export opportunities for Australia, estimating that by 2040 global demand could be valued at between $2.6 billion and $13.4 billion.2 The Australian hydrogen industry could have an associated domestic economic contribution of over $4 billion by 2040, as well as opportunities for over 7,000 full-time equivalent jobs.3

Opportunities for Australia

The development of a ‘hydrogen economy’ is attractive in a resource-rich country like Australia. Whether for domestic or export consumption, this potentially low emissions energy alternative could leverage Australia’s existing international competitive advantages.

At a snapshot, hydrogen may present an opportunity for Australia in the following ways:

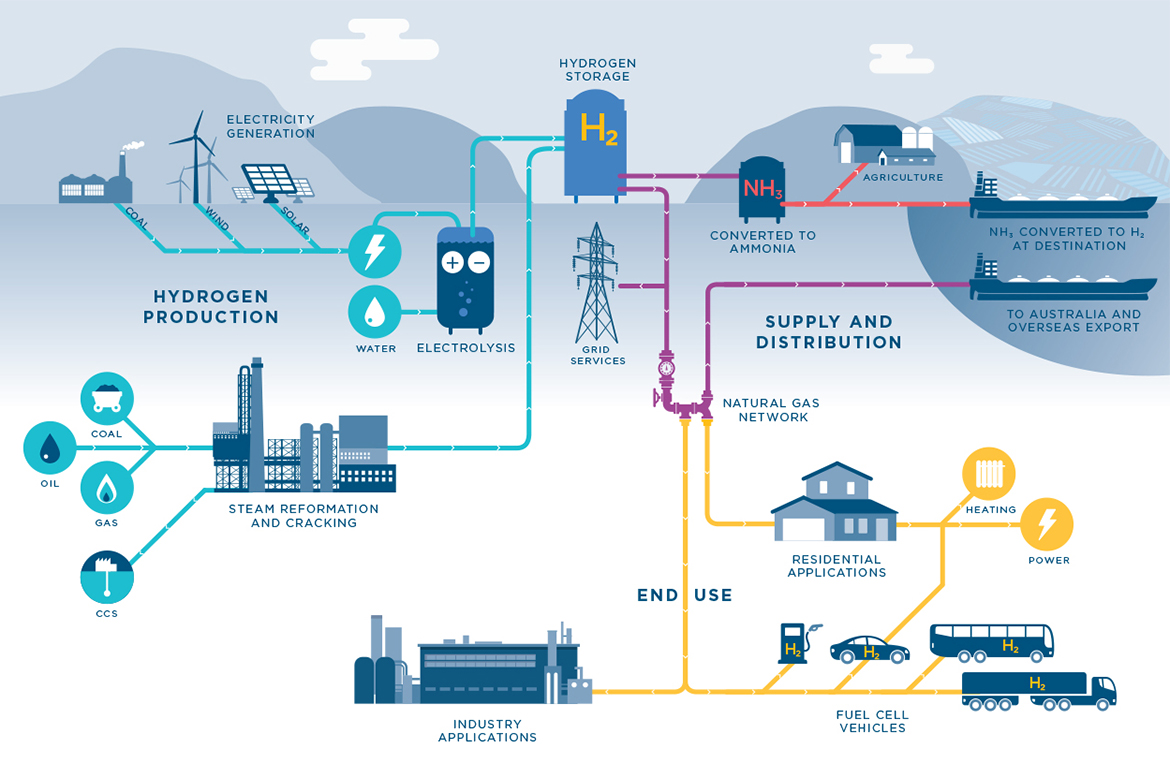

- Hydrogen production: maximise cheap electricity to produce hydrogen, with a focus on ‘green hydrogen’, with the ‘levelised cost of hydrogen’ produced by electrolysis expected to range between $2.29-$3.10/kg by 2025.4

- Energy system optimisation: capitalise on existing infrastructure by using hydrogen manufacture to provide grid services to the electricity network and also integrating supply to the gas network, where trials blending hydrogen and gas are already underway.

- End use innovation: commercialise diverse ‘end use’ applications for commercial, industrial and residential users, including hydrogen fuel cell vehicles, heating and power, with hydrogen in transport expected to accelerate over the next 10 years.5

- Social license to operate: developing global best practice for managing environmental impacts, safe handling and community acceptance of hydrogen.

These opportunities are considered below.

State Government Momentum

Australian governments are currently investigating the role of hydrogen in Australia’s energy transformation to a lower emissions economy – this includes consideration of the legal and policy landscapes required to grow the ‘hydrogen economy’. Various state governments have released policies and ‘roadmaps’ to encourage investment in hydrogen, including Victoria, Queensland, Western Australia and South Australia.

A National Hydrogen Strategy

On 1 July 2019 the ‘Hydrogen Working Group’, established by the Council of Australian Governments' (COAG) Energy Council and chaired by Chief Scientist Alan Finkel AO released a series of issue papers for public consultation in the next stage of developing a National Hydrogen Strategy (Issue Papers).

The purpose of the Issue Papers is to consider key issues in the development of policies and action in identified hydrogen opportunities. In this Legal Briefing we provide a brief overview of barriers and government initiatives identified in the Issue Papers.

The Hydrogen Working Group will release the draft National Hydrogen Strategy for public consultation in September 2019 and will present the final strategy to COAG Ministers in late 2019.

Hydrogen production: developing scale, investment and export

This section reviews the following Issue Papers: Hydrogen at scale; Attracting hydrogen investment; and Developing a hydrogen export industry.

Barriers to scaling hydrogen production:

- Capital – attracting sufficient capital (domestic and international, equity and debt)

- Technology – the limited commercialisation of certain technologies and need for upgrades to existing infrastructure

- Supply chain – high costs along the supply chain (particularly for green hydrogen) and skill gaps to transition workers in targeted growth areas.

Potential government initiatives to encourage hydrogen production at scale:

- Supporting commercialisation of key technologies i.e. incentives to reduce costs of production and transport

- Maintaining policy certainty i.e. advocating for harmonisation of international standards to reduce technical barriers to trade

- Enabling investment i.e. establishing bilateral agreements with key hydrogen consumers and trade partners.

Key legal issues for hydrogen production may include planning pathways for hydrogen infrastructure and commercial offtake and supply arrangements (domestic or export) to facilitate finance and investment.

Energy system optimisation: hydrogen for gas and electricity networks

This section reviews the following Issues Papers: Hydrogen in the gas network; and Hydrogen to support electricity systems.

Barriers to energy system optimisation:

- Integration – improving compatibility with existing gas and electricity network infrastructure

- Pilot projects – increasing practical demonstration projects in the market (i.e. hydrogen blending with gas)

- Market acceptance – addressing customer acceptance and affordability of new end-use hydrogen technologies (i.e. heating systems)

Potential government initiatives to encourage energy system optimisation:

- Coordination of infrastructure i.e. appropriately locating hydrogen facilities to meet network needs

- Supporting test projects i.e. funding for pilot projects

- Facilitation of exports i.e. linking hydrogen exports and the domestic and electricity, gas and transport sectors

Key legal issues for energy system optimisation may include regulatory parameters for hydrogen under existing regulatory frameworks for gas and electricity and regulatory requirements for the safe handling and transportation of hydrogen exports.

End use innovation: hydrogen for transport and industrial users

This section reviews the following Issues Papers: Hydrogen for transport; and Hydrogen for industrial users

Barriers to end use innovation:

- High costs – expensive infrastructure for hydrogen fuel cell electric vehicles (FCEV) and industrial applications

- Low technology deployment – limited accessibility of cleaner industrial alternatives (i.e. clean fuel, chemical feedstock and industrial heat)

Potential government initiatives to encourage end use innovation:

- Government purchasing i.e. fleet purchasing of FCEVs

- Industry transition i.e. regulation of safety standards and support to transition skill training to deploy the hydrogen sector

Key legal issues for end use innovation may include planning pathways and regulatory licensing for hydrogen infrastructure in transport or industrial facility retrof

Social license to operate: guarantees of origin and community concerns in the development of hydrogen

This section reviews the following Issues Papers: Hydrogen for transport; and Hydrogen for industrial users.

Barriers to a social license to operate:

- Carbon emissions – need to focus on ‘green’ hydrogen rather than fossil fuel based to reduce carbon emissions

- Resource use – increased water consumption and land use

Potential government initiatives to a social license to operate:

- Community consultation i.e. stakeholder engagement through planning process

- Guarantees of origin i.e. ensuring that an Australian scheme is uniform with international standards

Key legal issues for a social license to operate may include the regulation and harmonisation of standards for performance, safety and manufacturing of new equipment and technologies.

Endnotes

- ACIL Allen, Opportunities for Australia from Hydrogen Exports, August 2018.

- ARENA report.

- ACIL Allen, Opportunities for Australia from Hydrogen Exports, August 2018.

- ACIL Allen, Opportunities for Australia from Hydrogen Exports, August 2018, p 30.

- Hydrogen Council (2017), Hydrogen scaling up, a sustainable pathway for the global energy transition. p 26-27.

Key contacts

Legal Notice

The contents of this publication are for reference purposes only and may not be current as at the date of accessing this publication. They do not constitute legal advice and should not be relied upon as such. Specific legal advice about your specific circumstances should always be sought separately before taking any action based on this publication.

© Herbert Smith Freehills 2024