The long and winding road

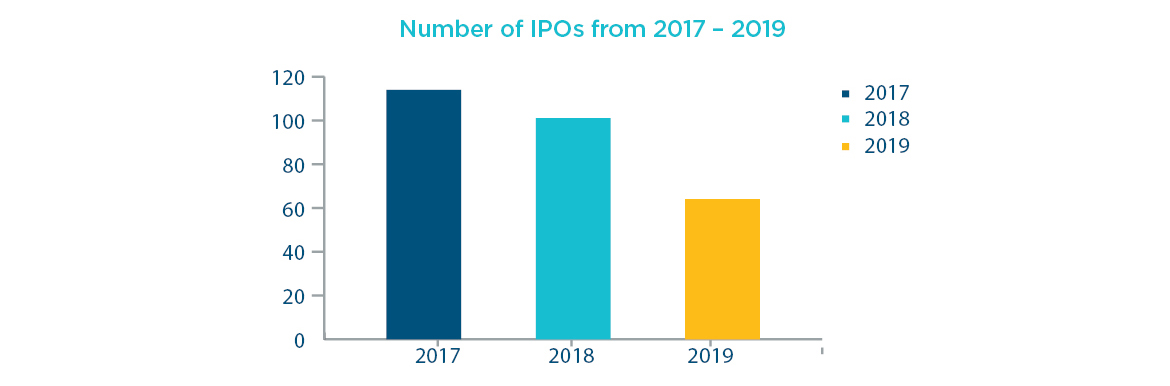

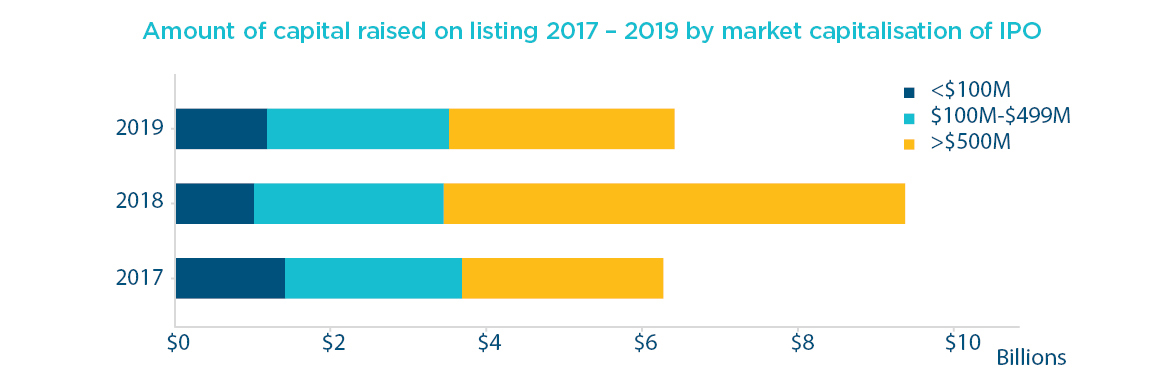

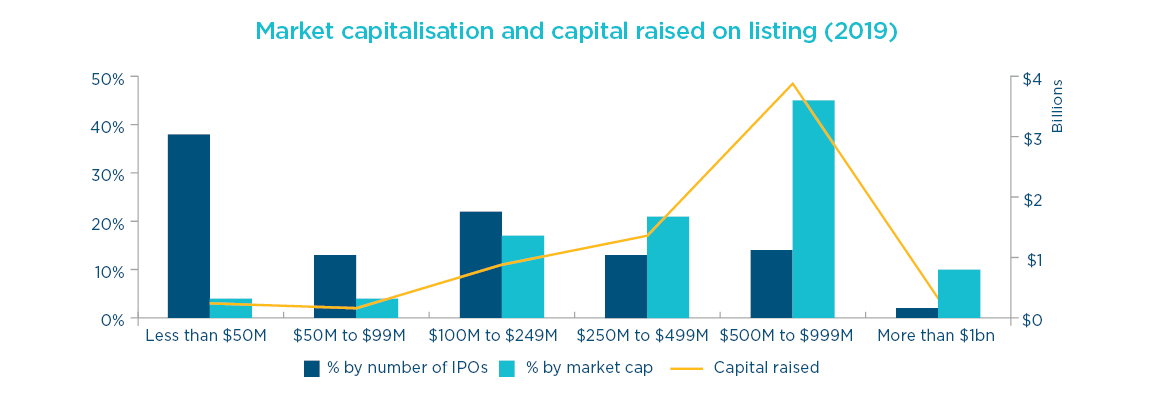

There were close to 40 fewer listings in 2019 as compared with 2018, and that figure is higher still if compared with 2017. Capital raised by IPOs in 2019 was also almost A$3 billion lower than in 2018. Beyond the floats, a number of proposed high profile floats were withdrawn, such as Latitude, Property Guru, Retail Zoo and Onsite Rental.

There was no one reason for this outcome, but a combination of factors clearly made listing on the ASX in 2019 a challenging task. The macro factors included elections in Australia and the UK and intensifying US-China trade tensions and the impression left by proposed international mega-IPOs like WeWork (whose valuations were significantly reduced once tested as part of the listing process).

There were also challenges with navigating the IPO process around ASIC’s restrictions on including formal valuations in sell-side research and ensuring allocation practises were able to be demonstrated to be consistent with ASIC’s recommendations provided in December 2018.

Whilst much has been made of the volume of capital requiring deployment by superannuation, pension and other types of funds, the overarching story of the last few years is that such investors have a strong yield focus and are disciplined when choosing whether to invest in a business at IPO. The success of REIT IPOs is consistent with this theme - we discuss some of the key features of REIT IPOs in 2019 Australian IPO Review: REIT IPOs – the answer for you?.

The journey ahead

Despite the numeric data, there were a number of new and exciting companies that listed on the ASX in 2019. A common theme amongst some of the more prominent listings was an investment story that showed capital being raised to fund growth opportunities. ASX also consolidated its position as a home for IT IPOs of all sizes, particularly FinTech, with its record for these listings continuing to attract global attention.

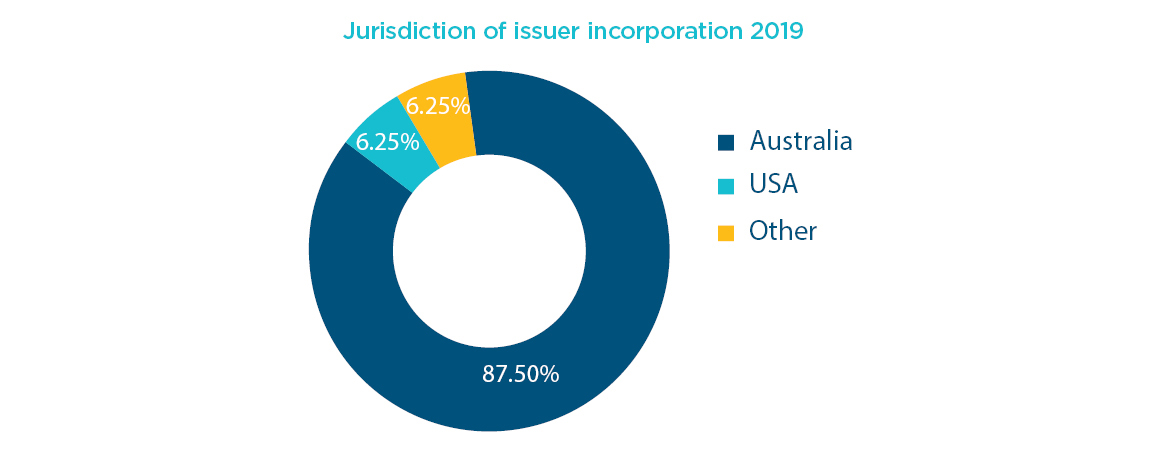

Geographic spread

There were a number of prominent listings of large foreign entities in the IT and financial services sector in 2019 including Fineos, Life360, Sezzle and Limeade. Consistent with ASX’s push for ASX to be recognised as a desirable destination for tech listings, the CEO of Sezzle, a payment solution platform offering interest free instalment payments, particularly in online checkouts, noted that ASX-investor familiarity with Afterpay was the reason for the choice of listing on the ASX when its operations were focussed on North America.

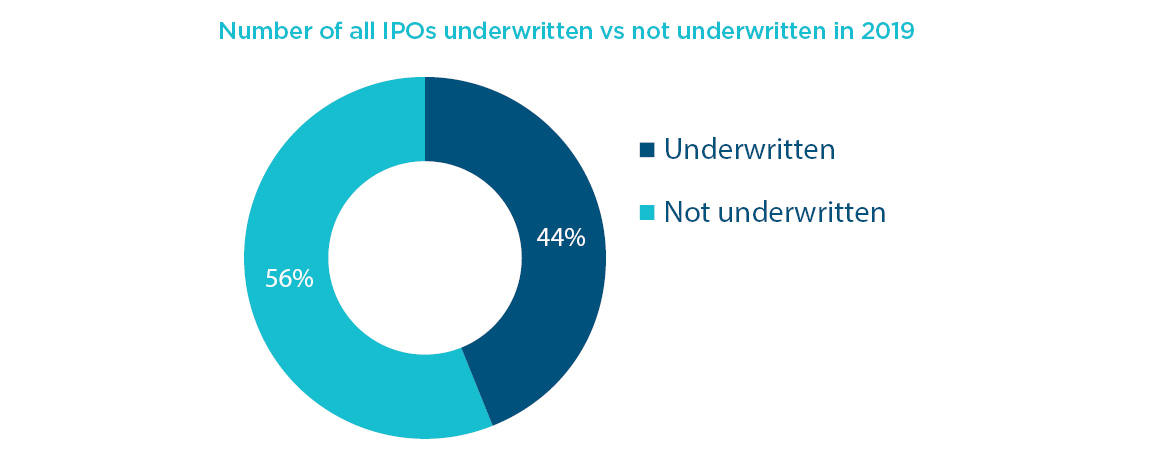

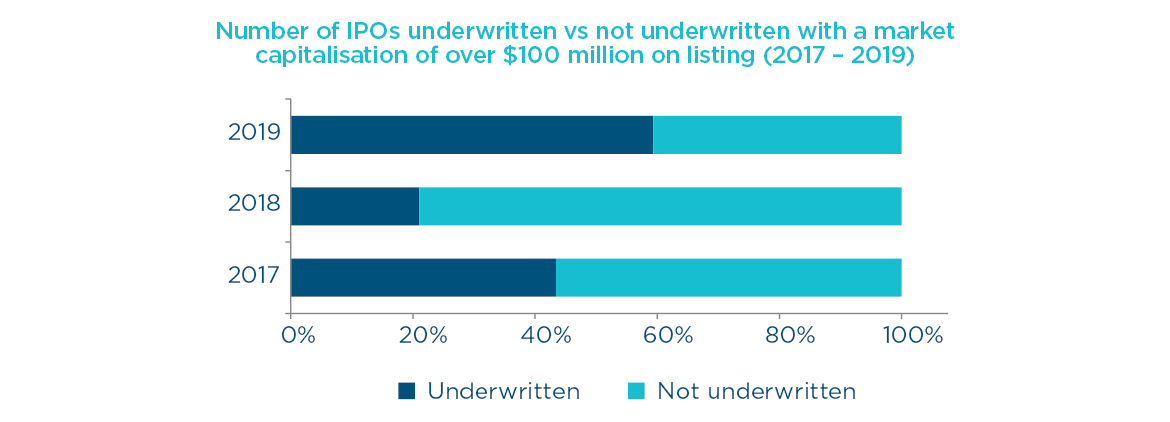

Underwriting

There was a higher proportion of underwritten IPOs in 2019 than previous years, although we are not drawing any particular conclusion from this and note the lower number of IPOs and capital raised generally in 2019 may have had an influence on this result.

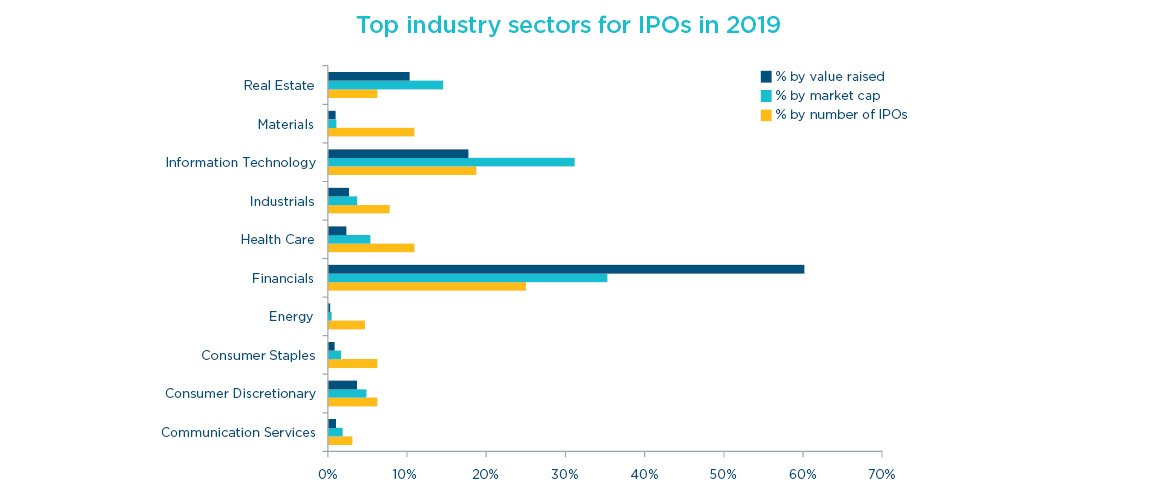

Sector spotlights

The financial sector dominated with a range of listed investment entities. Outside of investment entities, new listings included Prospa (online lending to small business), Powerwrap (platform provider for wealth advice groups), Teaminvest Private Group, (a specialist private equity firm), VGI Partners (fund manager), Quickfee (payment platform and SME lender to accounting and law firms), Sezzle (payment solution platform offering interest-free instalment payments), Moneyme (digital consumer credit) and Openpay (a payments platform).

Other than financial sector listings, there were more listings in the information technology sector than any other, with those listings also representing the highest aggregate market capitalisation of any sector outside of the financial sector.

Almost all of the IT sector listings were for IT companies that provide services to businesses. These included Splitit (credit card solutions for businesses), Readytech (SaaS to the education and employment sector), Whispir (SaaS automating interactions between businesses and consumers), Fineos (provider of software systems to the global life, accident and health insurance industry), Tyro (eftpos payment solutions), AppsVillage (SaaS to allow small to medium businesses to build their own branded apps), Nitro Software (Document productivity software), OpenLearning (cloud online learning platform) and Amaero (laser based additive manufacturing processes) and Icetana (video analytics to automatically identify anomalous actions in surveillance networks).

The notable exception to the business-to-business theme was Life360, which provides a location based services application for consumers (mostly families) to track contacts (such as family members).

The IT sector listings ranged from the small to some of the largest listings in 2019. ASX has recognised its attractiveness for IT company listings and has launched an index called the S&P/ASX All Technology Index in February 2020.

The sector raising the third most capital was real estate. Listings in this area included Investec Australia Property Fund (investing in Australian and New Zealand office, industrial and retail real estate), Victory Offices (providing serviced offices and virtual office facilities and flexible working spaces), Home Consortium (with a $925 million property portfolio targeting operating and retail service centres) and Primewest (real estate funds management). We discuss some of the key features of REIT IPOs in 2019 Australian IPO Review: REIT IPOs – the answer for you?

Note on Methodology: All data in this ‘2019: IPOs by the numbers’ section excludes ASX Foreign Exempt Listings, AQUA and debt IPOs unless otherwise stated. Market capitalisation is based on the issue price of securities multiplied by the number of quoted securities.

Legal Notice

The contents of this publication are for reference purposes only and may not be current as at the date of accessing this publication. They do not constitute legal advice and should not be relied upon as such. Specific legal advice about your specific circumstances should always be sought separately before taking any action based on this publication.

© Herbert Smith Freehills 2024