In AusNet 01, the Takeovers Panel considered a limited-period ‘hard’ exclusivity arrangement (without a ‘fiduciary out’) for the first time. These arrangements have been relatively common in recent times, but their use may be more limited following the decision.

|

In brief

|

|---|

Background

AusNet Services Limited (AusNet) was subject to competing proposals from both Brookfield Asset Management (Brookfield) and Australian Pipeline Limited as responsible entity of the Australian Pipeline Trust and APT Investment Trust (APA) for control of AusNet.

On 20 September 2021, AusNet announced that it had received an indicative cash proposal from Brookfield at $2.50 per share and that it had entered into a confidentiality deed with Brookfield (Confidentiality Deed) to allow for Brookfield to conduct due diligence on AusNet and for the parties to negotiate a scheme implementation deed on an exclusive basis over an eight week period (in that it was terminable by either party on seven days’ notice after seven weeks).

On 21 September 2021, APA announced a rival cash and scrip indicative proposal at equivalent of $2.60 per share, but AusNet indicated it was unable to engage with APA because of the exclusivity arrangement with Brookfield.

APA made an application to the Takeovers Panel (Panel) and sought a declaration of unacceptable circumstances in relation to the exclusivity arrangements contained in the Confidentiality Deed.

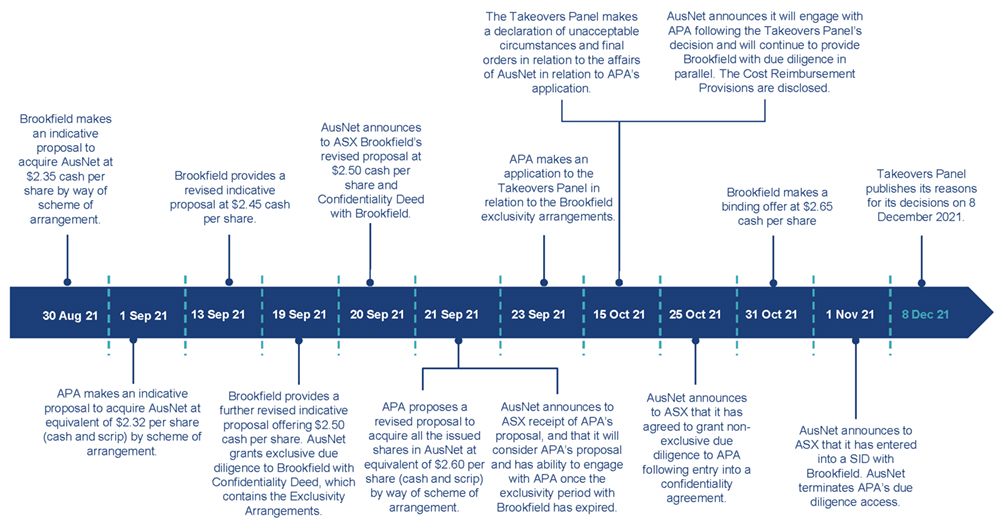

Timeline

Set out below is a high-level timeline of events leading up to the Panel’s declaration of unacceptable circumstances:

Exclusivity Arrangements in the Confidentiality Deed

The Confidentiality Deed contained a number of deal protection measures, including:

- a no-shop restriction, which prevented AusNet from soliciting competing proposals;

- a no-talk restriction, which prevented AusNet from participating in negotiations or discussions in relation to a competing proposal; and

- a notification obligation, which required AusNet to notify and provide certain details to Brookfield of any competing proposal received,

(the Exclusivity Arrangements).

The Exclusivity Arrangements were not subject to a ‘fiduciary out’ and applied for a rolling period of 8 weeks (in that it was terminable by either party on seven days’ notice after seven weeks).

The Confidentiality Deed also contained a cost reimbursement provision under which AusNet would, in certain circumstances, reimburse Brookfield’s costs of up to A$5 million (Cost Reimbursement Provision).

APA’s Application – AusNet 01

In its application to the Panel, APA submitted (among other things) that:

- the Exclusivity Arrangements provided Brookfield with 8 weeks of absolute exclusivity, including ‘no-talk’ and ‘notification’ restrictions which were not subject to a ’fiduciary out’ for AusNet to respond to potential competing proposals;

- the Exclusivity Arrangements prevented AusNet from responding to APA’s revised proposal for control of AusNet; and

- APA was not provided with a reasonable opportunity to improve its proposal prior to AusNet agreeing to enter the Confidentiality Deed.

APA submitted that the effect of the circumstances (including the entry into the Confidentiality Deed) hindered, or was likely to hinder, the acquisition of control of AusNet taking place in an efficient, competitive and informed market, and denied, or was likely to deny, AusNet shareholders an opportunity to participate in any benefits of a competing proposal.

APA sought final orders to the effect that the Exclusivity Arrangements be terminated or be made subject to a ‘fiduciary out’.

The Panel’s Decision

Declaration of unacceptable circumstances and orders made

The Panel made a declaration of unacceptable circumstances and made orders that:

- the no-talk restriction in the Confidentiality Deed would be of no force and effect unless the Confidentiality Deed was amended to include a ‘fiduciary out’ in relation to the ‘no-talk’ restriction; and

- AusNet must disclose the material terms of the Confidentiality Deed as affected by the orders, including the terms of the Cost Reimbursement Provision.

The Panel considered that the following aspects of the Exclusivity Arrangements, taken together, had an anti-competitive effect:

- the no-talk restriction, which prevented the AusNet board from responding to any competing proposal, including an unsolicited proposal or a proposal that had been publicly announced, during the exclusivity period;

- there was no ‘fiduciary out’ to the no-talk restriction;

- the exclusivity period operated for a minimum of eight weeks and could only be terminated with seven days’ prior notice; and

- the no-talk restriction was coupled with a notification obligation that required AusNet to provide Brookfield with all material terms and conditions of an actual, proposed or potential competing proposal.

The Panel also considered that the anti-competitiveness of the Exclusivity Arrangements was exacerbated by the delay in AusNet disclosing the full terms of the Exclusivity Arrangements.

Outcome of the Panel’s final orders

Following the Panel’s decision, on 15 October, AusNet announced that it would engage with APA and grant APA access to due diligence, subject to entry into a confidentiality deed. APA also announced that it intended to continue to grant due diligence to Brookfield in parallel. The terms of the Cost Reimbursement Provision were disclosed in this announcement.

On 1 November, AusNet announced that it had entered into a scheme implementation deed with Brookfield and had terminated APA’s due diligence access. AusNet’s announcement set out the rationale for its decision and considerations in entering the scheme implementation deed.

Reasons for Decision

The Panel considered the following:

Application of Guidance Note 7: Lock-up devices

Guidance Note 7 states that in “the absence of an effective ‘fiduciary out’, a no-talk restriction is likely to give rise to unacceptable circumstances”.

AusNet submitted that the Panel’s policy in Guidance Note 7 should not apply (or apply to a limited extent) to non-binding proposals because exclusivity could in fact facilitate the pursuit of a proposal or, as was the case in the competition between APA and Brookfield, an improvement in the terms of an indicative proposal.

Brookfield argued that the Panel should adopt the same approach taken in previous decisions on this subject, which is to adopt a principles based approach.

ASIC submitted that the underlying policy of Guidance Note 7 should apply equally to non-binding proposals and that the existence of the Exclusivity Arrangements without a ‘fiduciary out’, even if the ultimate proposal contained a ‘fiduciary out’, could limit the prospect of a competing proposal eventuating.

In the Panel’s view, Guidance Note 7 should apply to the circumstances of this matter, and the Panel found that the “anti-competitive impact of deal protection measures can be more significant in the context of non-binding proposals”.

Exclusivity Arrangements

AusNet submitted that the Exclusivity Arrangements were not unacceptable for reasons including that:

- as a result of disclosure of the Exclusivity Arrangements, potential competing bidders would become aware of Brookfield’s proposal and could submit competing proposals, which AusNet would be required to release publicly, which APA in fact did;

- Brookfield had insisted on the Exclusivity Arrangements in exchange for the price increase from its prior indicative proposal; and

- if AusNet entered into a scheme implementation deed with Brookfield, the scheme implementation deed exclusivity regime would contain a ‘fiduciary out’ and there would be a significant period between execution of the implementation deed and completion of the transaction in which a competing proposal could be considered.

Brookfield’s position was that the Panel should consider the circumstances leading up to the Exclusivity Arrangements and the effect of those circumstances as a whole, which included that the Exclusivity Arrangements had in fact facilitated competition and led to materially enhanced competition for control of AusNet. It noted that the Exclusivity Arrangements operated for a limited time, in circumstances where the Brookfield proposal had been made public, promoting emergence of competing proposals, and where, first, it would be open to AusNet to engage with any such competing proposals before entering into any scheme implementation deed with Brookfield and, secondly, even if AusNet entered into a scheme implementation deed with Brookfield, any exclusivity regime in such a deed would contain a ‘fiduciary out’.

ASIC submitted that a no-talk restriction without a ‘fiduciary out’ would have the effect of unduly stifling competition and could adversely impact the market for control.

The Panel concluded that deal protection measures and exclusivity arrangements must be subject to certain requirements to ensure that they do not unreasonably hinder competition for control, and referenced Panel guidance providing that:

- given the anti-competitive effect of a no-talk restriction may be greater than other forms of restriction, safeguards should be stringent; and

- the inclusion of an effective ‘fiduciary out’ is an important safeguard where a no-talk restriction has been imposed.

The Panel considered that the absence of a ‘fiduciary out’ even at the non-binding proposal stage could unduly inhibit competition for control of AusNet, despite the limited period over which the Exclusivity Arrangements operated. The Panel rejected the argument that a ‘fiduciary out’ to the deal protection measures in a subsequent implementation agreement would cure the anti-competitive effect of the absence of a ‘fiduciary out’ in the pre-binding bid Exclusivity Arrangements.

It was noted that even with a ‘fiduciary out’, the period of restraint of a no-talk restriction must be “limited and reasonable”. In respect of the Exclusivity Arrangements, the Panel’s concerns included that:

- the no-talk restriction applied without any ‘fiduciary out’ during the entire exclusivity period;

- the duration of the exclusivity period was at the longer end of market practice;

- the exclusivity period only ended if AusNet wished to end negotiations with Brookfield (or vice versa); and

- the manner in which the exclusivity period may be ended by AusNet effectively provided Brookfield with a seven-day period to negotiate exclusively with AusNet a revised proposal in response to any competing proposal.

Although Guidance Note 7 provides that a no-talk restriction is “less likely to give rise to unacceptable circumstances if the target has conducted an effective auction process before agreeing to it”, the Panel did not consider that the process that AusNet undertook prior to entering the Confidentiality Deed with Brookfield was an auction process and suggested that the lack of an auction process exacerbated the anti-competitive effect of the Exclusivity Arrangements.

Disclosure of Exclusivity Arrangements

The Panel agreed with the submissions made by APA and ASIC that the disclosure of the Exclusivity Arrangements by AusNet was not consistent with the Panel’s guidance in this area on the basis that:

- AusNet’s announcement of 20 September 2021 did not disclose the nature of the Exclusivity Arrangements (including the lack of a ‘fiduciary out’ to the no-talk restriction) or disclose “all relevant terms” of the Exclusivity Arrangements as required by Guidance Note 7;

- material terms of the Exclusivity Arrangements were not disclosed until 21 September 2021, being after both the announcement of Brookfield’s control proposal and the public announcement by APA of its competing proposal; and

- the Cost Reimbursement Provision ought to have been disclosed along with all the other “relevant terms” of the Exclusivity Arrangements because it operated as Brookfield’s sole remedy against AusNet in connection with the matters contemplated by the Confidentiality Deed including the Exclusivity Arrangements, and was accordingly relevant to the Exclusivity Arrangements regardless of the maximum quantum of the costs to be reimbursed.

Overall effect of the circumstances was unacceptable

The Panel noted that in considering the matter, it looked at the surrounding circumstances and context rather than individual aspects of the Exclusivity Arrangements. The Panel further noted that it had not sought to second guess the commercial reasons of the AusNet board in pursuing the Brookfield proposal, but had instead considered that the effect of the circumstances, in totality, were unacceptable.

Commentary on the Panel’s decision

The Panel’s decision in AusNet 01 provides guidance that:

- Guidance Note 7 will apply in the context of a limited-period exclusivity regime in connection with a non-binding proposal, even if any eventual binding proposal will contain a ‘fiduciary out’;

- an 8-week exclusivity period is considered by the Panel to be “at the longer end of market practice”;

- a no-talk restriction is less likely to give rise to unacceptable circumstances if the target has conducted an effective auction process before agreeing to it; and

- a delay in disclosure of the material terms of exclusivity arrangements (which can be effected by disclosing an extract of the relevant clauses) can contribute to an anti-competitive effect that could give rise to unacceptable circumstances.

In light of this decision, targets may be less willing to grant due diligence for even a limited period without a ‘fiduciary out’, potentially leaving targets with one less enticement to trade for a higher indicative price.

As a result, in our view, it is likely that bidders will be less willing to allow announcement of proposals, since obviously a private period of exclusive due diligence, albeit with a ‘fiduciary out’, may in effect have the same outcome as a period of ‘hard’ exclusivity – and with the added benefit of potential rival bidders not being alerted to their due diligence or exclusivity (if leak risk can be managed). They will also be wary of making any concessions in return for exclusivity arrangements, without certainty that such arrangements will actually be enforceable.

The Panel’s decision does leave a number of points potentially open. Because the Panel considered a range of factors in reaching its conclusions, the Panel has not ruled out that a limited period of ‘hard exclusivity’ may be acceptable, but it will depend on all the circumstances and the overall effect of the exclusivity regime agreed. For example, a shorter period of ‘hard’ exclusivity, potentially followed by a short period of non-exclusivity (as was recently announced in relation to Iress Ltd)1 could be acceptable.

In addition, there are numerous examples of competing proposals being submitted after a scheme implementation deed has been entered into, and the target engaging with the rival bidders in relation to them under a ‘fiduciary out’ in the scheme implementation deed, as occurred in Vitalharvest Freehold Trust,2 Webcentral,3 and Asciano.4 To this end, in our view, the ‘fiduciary out’ in a scheme implementation deed should address any issues that could arise from a shorter period of prior exclusivity, albeit the Panel found that the prospect of a ‘fiduciary out’ in a subsequent implementation agreement was not sufficient to address its concerns in the specific circumstances of AusNet 01.

The ambit of the Panel’s comments on the unacceptable impact of the delay in disclosure also leave areas of uncertainty. One possibility may be that the Panel is signalling that due diligence should no longer ever be ‘private’, at least where conducted on an exclusive basis, but that would seem a fairly far-reaching and novel outcome. However, assuming non-exclusive ‘private’ due diligence, or ‘private’ due diligence subject to a ‘fiduciary out’ remain permissible, that would seem to be a channel which bidders are likely to favour – albeit it is one which leaves them subject to leak risk.

Target boards which do agree to limited periods of exclusivity with no ‘fiduciary out’ may also want to be in a position to demonstrate that an effective auction process has been undertaken, with records and materials to support this position, and ensure that they have made appropriate disclosure as it relates to any such exclusivity arrangements. The Panel’s comments on target board obligations may tend to send target boards down a particular and formulaic route, and arguably represent a departure from the position adopted in a number of earlier cases (such as Goodman Fielder Ltd 02 [2003] ATP 5, GBST Holdings [2019] ATP 15, Gloucester Coal Ltd 01R(a) and (b) [2009] ATP 9 at [71]) where the Panel declined to second guess a target board which was clearly motivated in its actions by a wish to get the best outcome for shareholders (noting that the steps the AusNet board took in this case do appear to have been taken with shareholders’ best interests in mind, following consultation with a ~32% shareholder whose support was essential for the success of any proposal, and demonstrably led to a higher price to the benefit of shareholders).

Endnotes

- See Iress Ltd’s ASX announcements dated 11 August 2021 and 10 September 2021, which contains exclusivity terms in the Process Deed (the ‘fiduciary out’ in respect of the ‘no talk’ obligation only applied 10 days after entry into the Process Deed).

- See, for example, Vitalharvest’s ASX announcement dated 8 June 2021.

- See, for example, Webcentral’s ASX announcement dated 15 September 2020.

- See, for example, Asciano’s ASX announcement dated 10 November 2015.

Key contacts

Legal Notice

The contents of this publication are for reference purposes only and may not be current as at the date of accessing this publication. They do not constitute legal advice and should not be relied upon as such. Specific legal advice about your specific circumstances should always be sought separately before taking any action based on this publication.

© Herbert Smith Freehills 2024