Stay in the know

We’ll send you the latest insights and briefings tailored to your needs

In October 2017, Herbert Smith Freehills sponsored a report by The Economist Intelligence Unit (The EIU) entitled Mergers and acquisitions in a changing world - Opportunities amidst disruption.

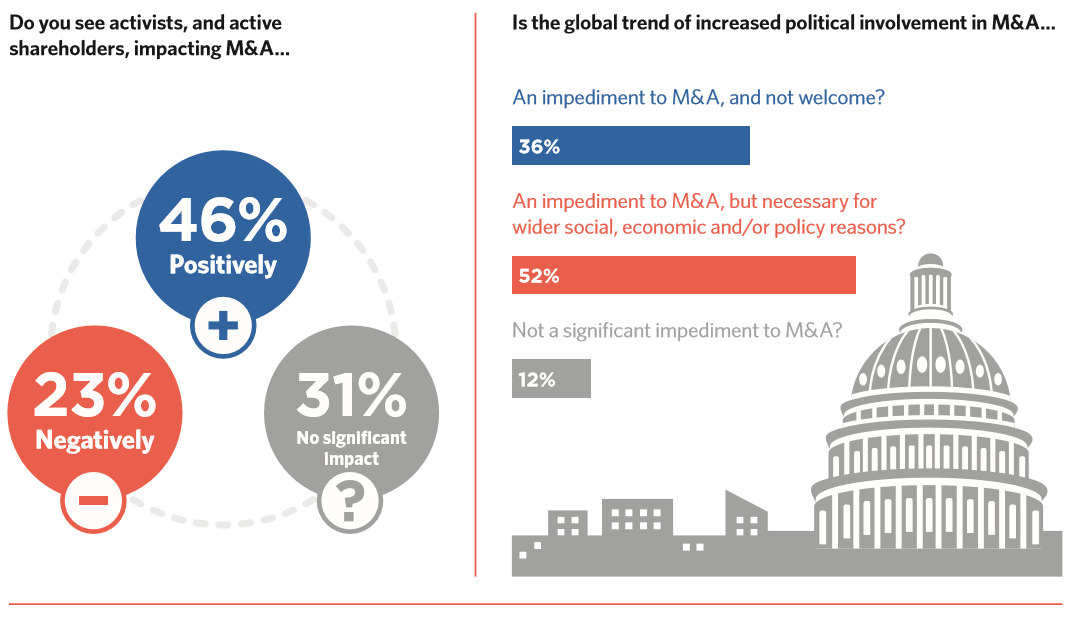

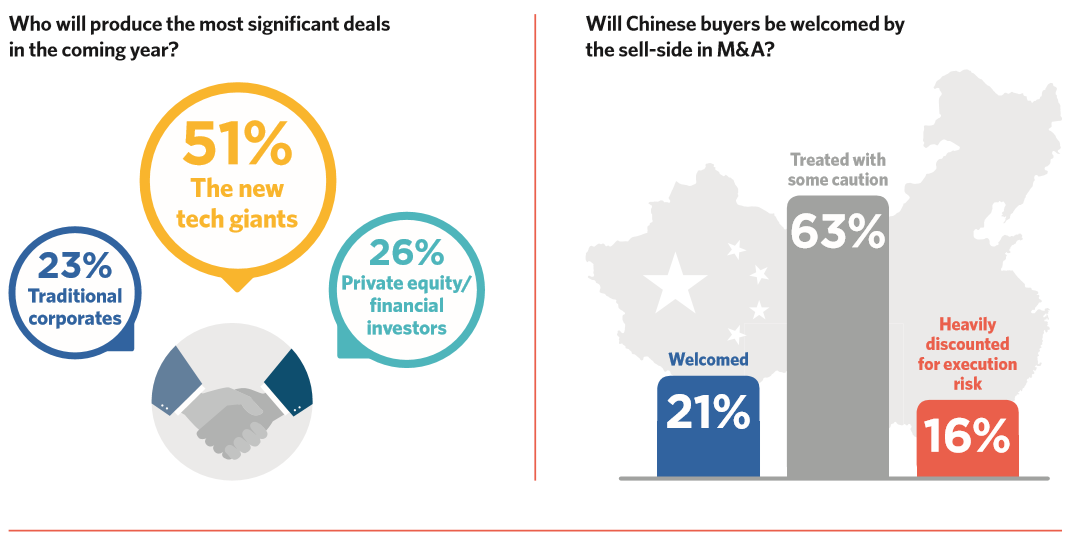

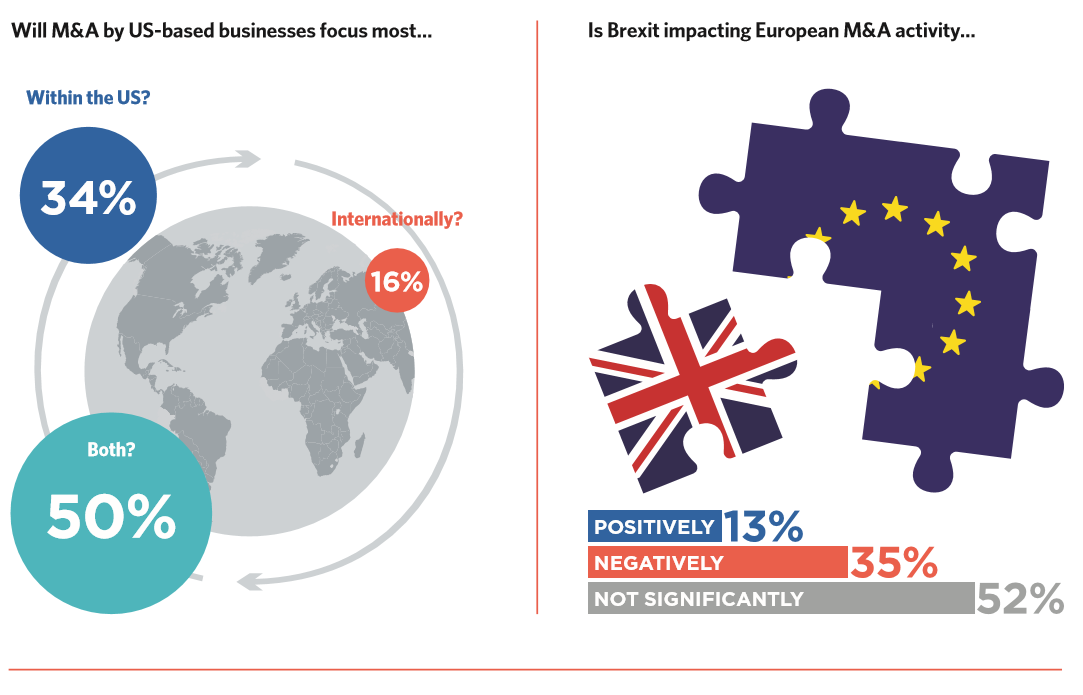

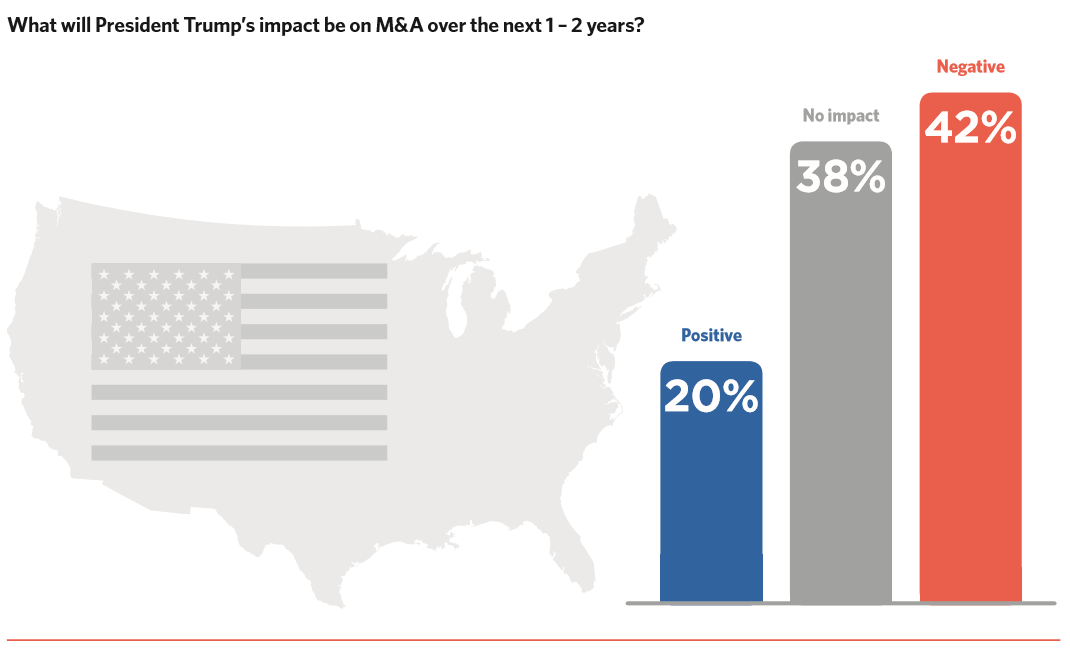

The EIU Report assessed the state of play on global M&A in this current period of unprecedented and unanticipated political change. The report focused on the headwinds created by the political environment, and the increased appetite from politicians to scrutinise and intervene in M&A. The EIU Report also drew attention to the strong drivers of global M&A activity, in particular the disruptive effect of technology across every sector, and the prevalence of new players active in or driving M&A, such as the new tech giants, Chinese buyers and activist shareholders.

The Economist Group and Herbert Smith Freehills then held a series of events to discuss these issues and polled senior executives and advisers involved in M&A, across four commercial hubs to gauge the current mood in the UK, Continental Europe, Asia Pacific and the US. This Supplemental Report sets out the views from those hubs and reports back on further insights gained from those engagements.

Those engagements confirmed a number of legal and regulatory themes familiar to Herbert Smith Freehills throughout 2017. These are themes where clients have sought our advice to answer questions such as: What investment screening regimes will my M&A deal be subject to? What political considerations may come into play or how will these regimes change in the future? How should we respond to activist shareholders? To what extent might shareholders influence my proposed M&A deal and how could shareholder activism be a catalyst for new M&A activity?

Clients from China have sought help in navigating outbound investment restrictions and in presenting themselves to US, European and other Asia Pacific sellers as counterparties or partners on deals. Clients considering transacting with Chinese companies have also sought help in assessing them as counterparties or partners. And we are seeing an increasing need to help clients assess the evolving legal and regulatory frameworks around new technologies, in particular the use of data, as businesses seek to join the fourth industrial revolution through M&A.

Accordingly, this Supplemental Report includes our views on those key legal and regulatory issues which are a common theme across our global M&A practice.

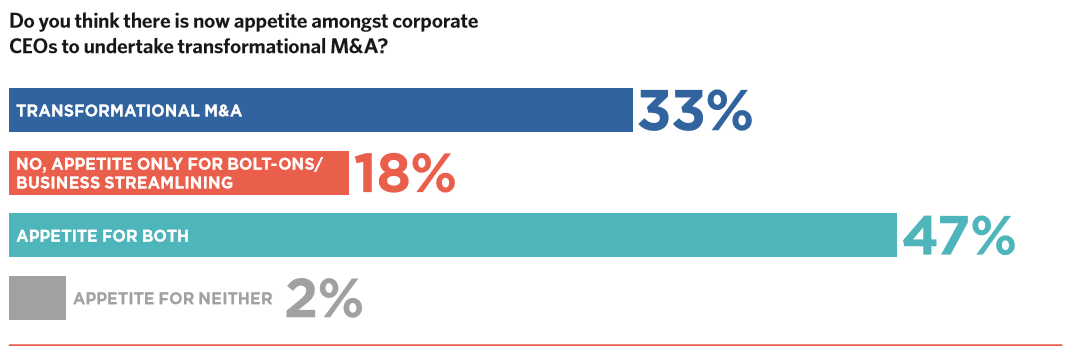

The views from The Economist Group engagements and the polling conducted confirmed the conclusions of The EIU Report. The benign conditions for M&A globally of a surplus of cash and record private equity dry powder, combined with continued low borrowing costs, and generally strong underlying economic fundamentals, explain the recovery of M&A to pre-global financial crisis levels. Notwithstanding political surprises and uncertainties, corporate leaders are engaging with M&A, albeit with measure and care, rather than unbound “animal spirits”. Equally, private equity’s business model needs to continue to transact, notwithstanding the challenge of high valuations on the buy-side.

Major global issues remain unresolved that are relevant to M&A. At the time of writing these vary from the outcomes of US tax reform, the shape of Brexit, the North Korean situation and the issues raised by the AT&T Time Warner antitrust case. Each of these, and many other issues, could have a significant effect on appetites for M&A, and which geographies or sectors might be most active.

But there is reason for cautious hope that business leaders will not lose sight of economic fundamentals, and that those leaders will continue to seek the necessary growth and technological transformation through M&A, despite present uncertainties or future challenges.

We’ll send you the latest insights and briefings tailored to your needs