On 18 August 2022, the Commonwealth Government released draft legislation proposing five-fold increases in the maximum penalties that apply to companies and individuals under Australia’s competition and consumer laws.

Key takeaways

- Penalties ordered by Courts, have increased rapidly in recent years, particularly for consumer law infringements, with two recent instances with penalties exceeding $100 million. These changes, if implemented, will accelerate this trend.

- Competition and consumer law compliance must be a core priority for all businesses given the significance of the penalties. Businesses should ensure that they implement and maintain robust compliance and customer service processes to mitigate the risk of breaching the law and to demonstrate a culture of compliance.

Overview of the proposed changes

On 18 August 2022, the Commonwealth Government released Exposure Draft legislation proposing to increase the maximum financial penalties for breaches of competition and consumer law:

- For companies, the proposed maximum penalty for a relevant contravention of the competition or consumer law would be raised to the greatest of:

- $50 million;

- three times the value of the benefit obtained; and

- 30% of the company’s adjusted turnover during the breach turnover period for the offence.1

- For individuals, the proposed maximum penalty would be raised to $2.5 million.

Penalties for contraventions of the consumer law were increased less than 5 years ago. If these changes proceed, the maximum penalty for contraventions of the consumer law will be increased by almost 50 times over a 5 year period (from a maximum penalty of $1.1 million pre September 2018 to a proposed maximum penalty of $50 million).

The table below shows how maximum civil penalties have increased over the last 5 years.

|

Pre September 2018 |

Current |

Proposed | |

|

Companies |

Competition law: $10 million |

$10 million |

$50 million |

| Consumer law: $1.1 million | |||

| Companies (percentage turnover) | Competition law: 10% of preceding 12 months | 10% of preceding 12 months | 30% of turnover period |

| Consumer law: na | |||

| Individuals | Competition law: $500,000 | $500,000 | $2,500,000 |

| Consumer law: $220,000 |

Exponential increase in consumer law penalties

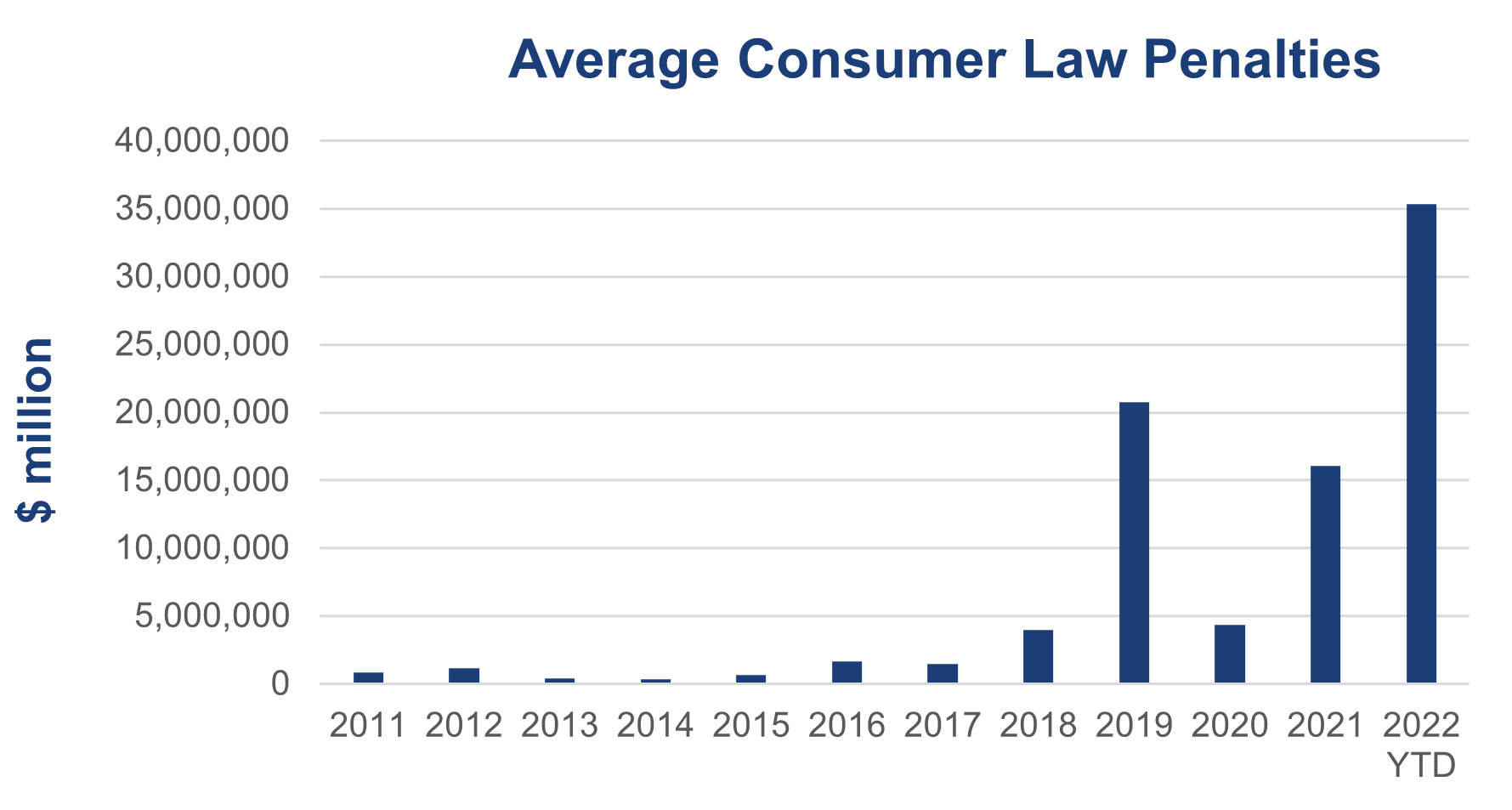

Even without increases to maximum penalties, civil penalties for contraventions of the consumer law have been increasing rapidly.

For example, in 2019, the Federal Court ordered Volkswagen to pay then record penalties of $125 million for contraventions of the consumer law relating to the emissions of its diesel engines. In 2021, this record was broken when the Federal Court ordered AIPE to pay a penalty of $153 million. In both cases, due to when the conduct occurred, the penalties were calculated based on the maximum penalties that applied prior to September 2018.

The figure below shows how average annual penalties for contraventions of the consumer law have increased over the last decade.

The effect of the changes in 2018 is only beginning to be seen, as cases involving conduct under the post-2018 penalty regime make their way through the Court system.

The exponential increase in consumer law penalties is likely to continue to accelerate if the Government’s proposed changes are implemented. Before the Federal election, Labor was forecasting an additional $555 million in revenue from increased penalties for contraventions of the competition and consumer laws. The majority of this would likely come from consumer law enforcement where the volume of successful ACCC proceedings is higher.

Given the exponential increases in penalties (even before increases to maximum penalties take effect), it is likely that, rather than being the exception, penalties in excess of $100 million will become common under the Competition and Consumer Act 2010 (Cth). This will bring Australia’s penalty regime more in line with overseas jurisdictions such as the EU, where penalties exceeding EUR 1 billion are not uncommon.

Taking steps to minimise breaches of competition and consumer law

Given the consequences, it is increasingly important that businesses are vigilant in minimising the risk of becoming involved in an ACCC investigation or enforcement proceeding.

Businesses should ensure that they implement and maintain robust and adequately resourced compliance processes to mitigate the risk of ACCC investigation and enforcement proceedings.

As part of such processes, businesses should ensure that their customer engagement teams are adequately trained to receive and respond to customer complaints. The ACCC is increasingly bringing proceedings regarding alleged misleading conduct arising out of complaints handing processes.

Not only does a well trained and resourced customer engagement team reduce the prospect of such misleading conduct arising, data from such customer interactions is analysed for early warning signs regarding potential competition and consumer law concerns.

Boards and executive teams should therefore consider their current competition and consumer law policies that their companies have in place, as well as how recently relevant sales and pricing teams have received training on competition and consumer law risks. In addition, companies should ensure that in-house legal teams are sufficiently equipped to consider the compliance of provisions in both existing standard-form contracts and proposed contracts with consumer law provisions.

Key contacts

Linda Evans

Regional Head of Practice – Competition, Regulation and Trade, Australia, Sydney

Legal Notice

The contents of this publication are for reference purposes only and may not be current as at the date of accessing this publication. They do not constitute legal advice and should not be relied upon as such. Specific legal advice about your specific circumstances should always be sought separately before taking any action based on this publication.

© Herbert Smith Freehills 2024

Stay in the know

We’ll send you the latest insights and briefings tailored to your needs