In the lead up to this year’s federal election, both of Australia’s major political parties have released announcements regarding the establishment of an Australian hydrogen industry.

A key focus of these announcements is the commitment to investing in ‘green’ hydrogen technologies, which through a process known as electrolysis, uses electricity generated from renewable sources to produce zero-emissions hydrogen by splitting water molecules into hydrogen and oxygen.

The recent attention on green hydrogen technologies follows the earlier publication of reports by several key Australian bodies, including by CSIRO and ARENA, which highlight the potential for Australia to establish a world-leading green hydrogen industry – to be fuelled by Australia’s abundant renewable energy resource, and which could meet the growing demand for hydrogen exports to countries such as Japan and South Korea.

Recent Developments

Hydrogen Working Group

On 1 March 2019, the Coalition Government announced that the ‘Hydrogen Working Group’, established by the Council of Australian Governments' (COAG) Energy Council and chaired by Chief Scientist Alan Finkel AO, is now open for consultation. The Hydrogen Working Group will work with industry experts and environment and community groups to develop a national strategy for Australia’s hydrogen industry, and will focus on key areas including using hydrogen for:

- export to regional markets;

- transport;

- use in gas networks; and

- industrial users.

The Hydrogen Working Group’s draft strategy is expected to be publicly released in September 2019.

This follows the Coalition Government’s earlier announcement that it will commit $50 million, alongside a similar commitment made by the Victorian Labor Government, to conduct a feasibility study in relation to the conversion of brown coal to hydrogen for export from Victoria’s La Trobe Valley.

Labor’s National Hydrogen Plan

The Federal Labor Party also recently announced its ‘National Hydrogen Plan’ which, if Labor is elected at the next federal election, will see $1.14 billion being allocated to bolster Australia’s hydrogen industry.

The highlights of Labor’s announcement include:

- allocating $1 billion of CEFC funding to support green hydrogen technologies;

- directing $100 million of ARENA’s budget to the development and deployment of hydrogen technologies, and establishing refuelling infrastructure for hydrogen fuel-cell vehicles across Australia; and

- pursuing international agreements for exporting Australian green hydrogen.

What is green hydrogen used for?

The nature of green hydrogen production technologies is such that it can be added to new or existing electricity-generating projects to optimise a project-owner’s return on its initial investment.

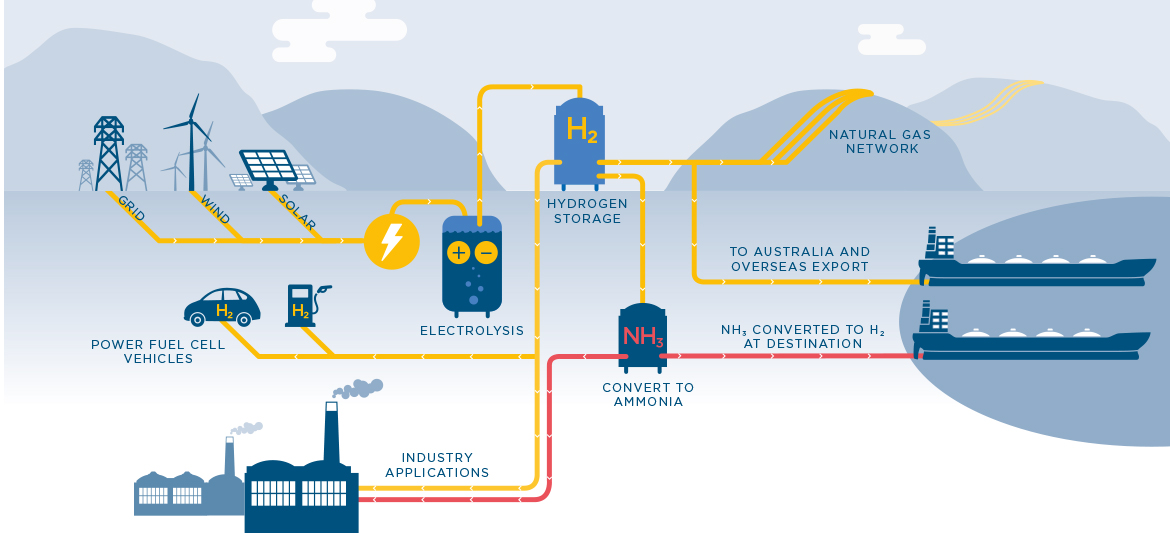

Once produced, the hydrogen can be used for a variety of industrial, agricultural and transportation applications. As demonstrated in the diagram below, this includes using hydrogen:

- as an exportable renewable fuel, either in liquid form or by converting hydrogen into ammonia which can then be exported globally;

- in the transport sector, to power hydrogen fuel-cell vehicles such as cars and trains;

- as an energy source by being gas injected into gas networks; and

- in industry, including for fertiliser production and petroleum refining.

We set out below some key considerations our clients should take into account when considering and assessing the viability of hydrogen production facility developments in Australia.

Five key considerations

1. Work, health & safety and community engagement considerations

One of the key questions developers should ask is whether a hydrogen production facility will be classified as a ‘major hazard facility’ (MHF).

MHFs are facilities which store, handle and process large quantities of hazardous materials and are subject to stringent safety, reporting and licencing requirements.Understanding whether a facility will be a MHF at an early stage of the project is critical.

A related consideration is to ensure that robust community engagement measures are implemented before any development activities begin. Given the public perception of hydrogen, and scepticism as to its safety, failing to properly educate the community on the realities of hydrogen production could threaten to derail a project’s success.

2. Requirements under environmental laws

Any hydrogen production facility will be subject to various environmental regulations, at both a federal and state level.

At an early stage of the development process, project owners should be considering:

- if the facility will be engaging in any activity that may have a ‘significant impact’ on a ‘matter of environmental significance’, and whether the matter needs to be referred for approval under the Environment Protection and Biodiversity Conservation Act 1999 (Cth);

- whether any licences are required under federal and state legislation, for example in South Australia, an environmental licence under the Environmental Protection Act 1993 (SA); and

- whether reporting to the National Pollutant Inventory is required, and if so, the relevant reporting obligations that will apply.

3. Storage and transport of hydrogen

The on-site storage of hydrogen following production, and its subsequent transport off-site, is heavily governed by a number of laws, regulations and codes at both a federal and state level. It is also important to note that a number of substances other than hydrogen may also be present on site during the production process, such as potassium hydroxide, which may also be subject to these requirements.

Some of the key considerations in determining the relevant compliance, licencing and reporting obligations that will apply to a facility include:

- whether any ‘dangerous goods’ or ‘dangerous substances’ will be present at the facility under the ‘Australian Code for the Transport of Dangerous Goods by Road and Rail’;

- if dangerous goods or substances will be present, which licences will be required to store or transport the relevant good or substance – for example, in South Australia under the Dangerous Substances Act 1979 (SA); and

- depending on the volume and type of the dangerous goods or substances that will be stored or transported, which technical standards that will apply – for example, in relation to the permitted types and specifications of storage tanks.

4. Requirements for sourcing water for hydrogen electrolysis

One of the key challenges in the production of green hydrogen is sourcing and securing a sufficient volume of suitable quality water for use in the electrolysis process.

Project developers will need to understand:

- if required, the licencing and permitting requirements for connecting to the water network in the State the facility is located; and

- if seawater will be used, the State-based relevant licencing requirements associated with operating a desalination facility – including in relation to brine disposal and management, and limitations on increasing water temperatures near the point of discharge.

5. Gaps in hydrogen regulation

There is currently no targeted regulation for hydrogen production facilities in Australia.

As highlighted above, regulatory reform will be a key area of focus from both major political parties in the coming years – however currently any hydrogen production facility will be governed by existing gas, energy, water and environmental regulations.

In light of this, and depending on the end-use applications being considered by developers of hydrogen production facilities, it is important to understand the current regulatory framework which applies to:

- the export of hydrogen and its related substances, in both Australia and the destination country of export; and

- participation in the domestic gas market, if hydrogen being supplied to the gas network is being considered.

Who to speak with at HSF

HSF has experience advising clients in relation to the legal, regulatory and licencing requirements for developing a green hydrogen facility, and is a market-leading adviser on renewable energy projects.

Our global energy sector team comprises a deep bench of energy specialists across disciplines and sub-sectors on the ground in key jurisdictions. Widely recognised as one of the pre-eminent energy firms globally, we act for the world's leading energy companies on all aspects of their businesses, projects andinvestments. We bring an unrivalled global platform, a genuinely integrated network and deeply embedded energy sector specialty.

If you are interested in further information , please contact:

Key contacts

Legal Notice

The contents of this publication are for reference purposes only and may not be current as at the date of accessing this publication. They do not constitute legal advice and should not be relied upon as such. Specific legal advice about your specific circumstances should always be sought separately before taking any action based on this publication.

© Herbert Smith Freehills 2024